Leveraged ETFs can offer magnified returns in the short run. But in the long run, the combination of daily rebalancing and compounding can impact their performance. In this guide, we’ll explore ETF compounding risk, how daily rebalancing works, and its effect on leveraged ETF performance.

What is daily rebalancing in leveraged ETFs?

Daily rebalancing is how leveraged ETFs maintain their target leverage (e.g., 2x). At the end of each trading day:

If the underlying stock or index gains, the ETF increases its exposure to match the next day’s target leverage.

If the underlying stock or index loses, the ETF reduces its exposure to prevent over-leverage.

Because rebalancing happens daily, performance over time depends on the path of returns – not just the total change. This rebalancing ensures the ETF achieves its stated multiple of daily returns. But it also means that compounding – the process of returns building on previous returns – plays a major role over time.

How does compounding impact leveraged ETFs?

Compounding can amplify returns in a trending market, but it can work against you in volatile or sideways markets.

Assume you invest in a 2x leveraged ETF tracking an underlying stock – and hold it for 10 days. The next three examples show how daily rebalancing of the ETF could affect its compounded returns, depending on the stock’s performance.

Example 1: Nvidia gains 2% per day for 10 days

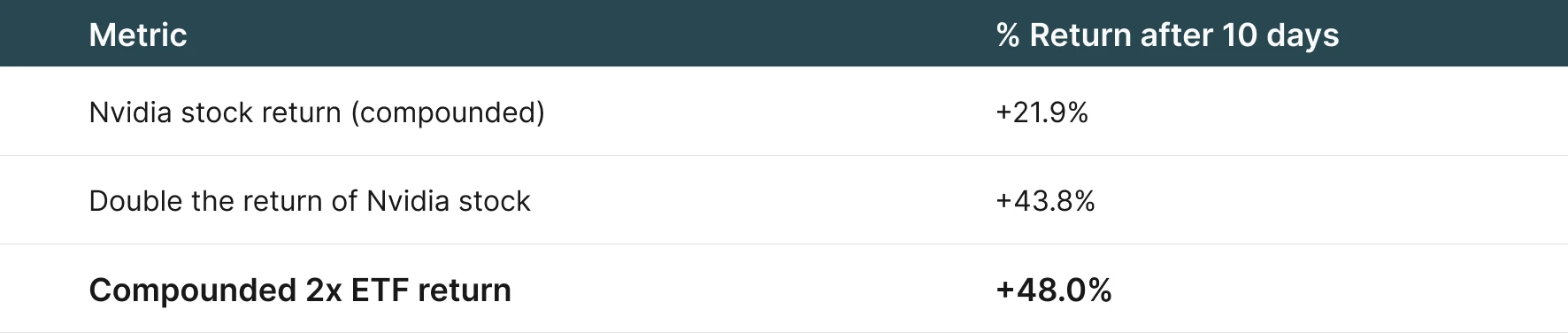

Assume Nvidia gains 2% every day. Using the Leverage Shares 2X Long Nvidia Daily ETF (NVDG), the table below shows the returns after 10 days.

Note: all examples are illustrative and exclude fees, expenses, and trading costs. Returns shown are estimates for illustration only and do not reflect actual performance.

Nvidia stock on its own would gain 21.9%. Each day, it would rise by 2% on top of the prior day's increase. Note that this is different from simply adding up 2% per day for 10-days to get 20%.

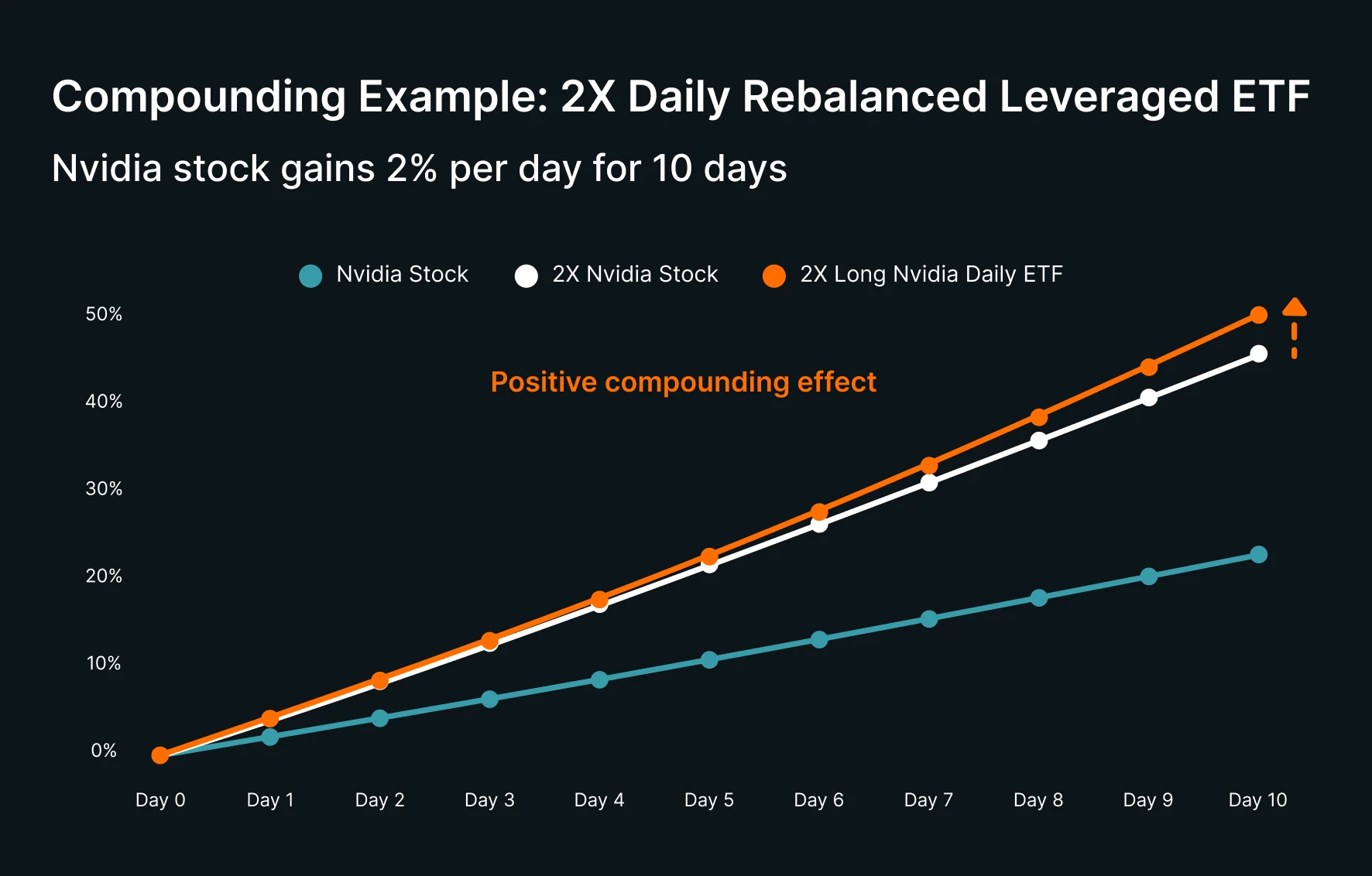

With a steady uptrend, the "compounding effect” of leveraged ETFs can work in your favor. Notice in the chart below how the compounded 2X ETF return was more than double the return of Nvidia stock.

Graphics are illustrative, shown before fees and expenses.

Example 2: Tesla loses 2% per day for 10 days

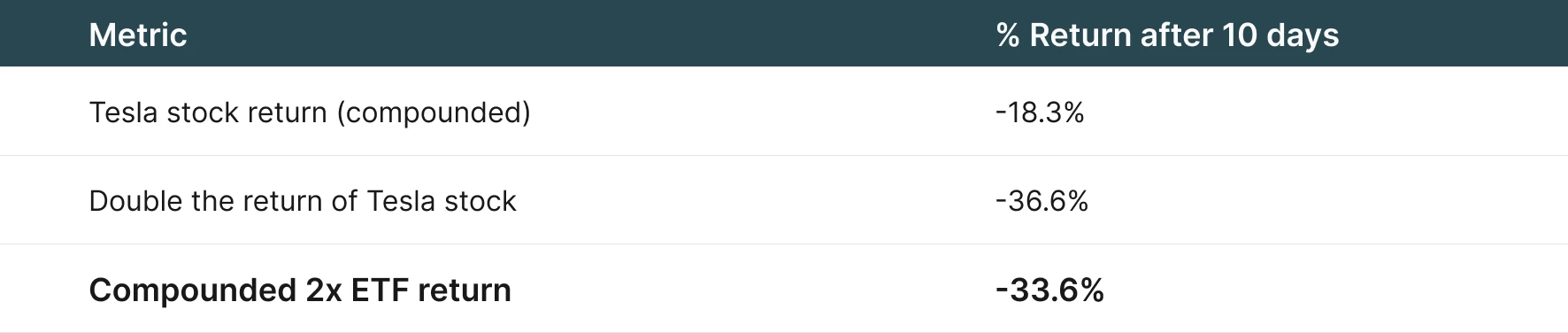

Let’s now say that Tesla drops 2% per day. Using the Leverage Shares 2X Long Tesla Daily ETF (TSLG), here are the total losses after 10 days:

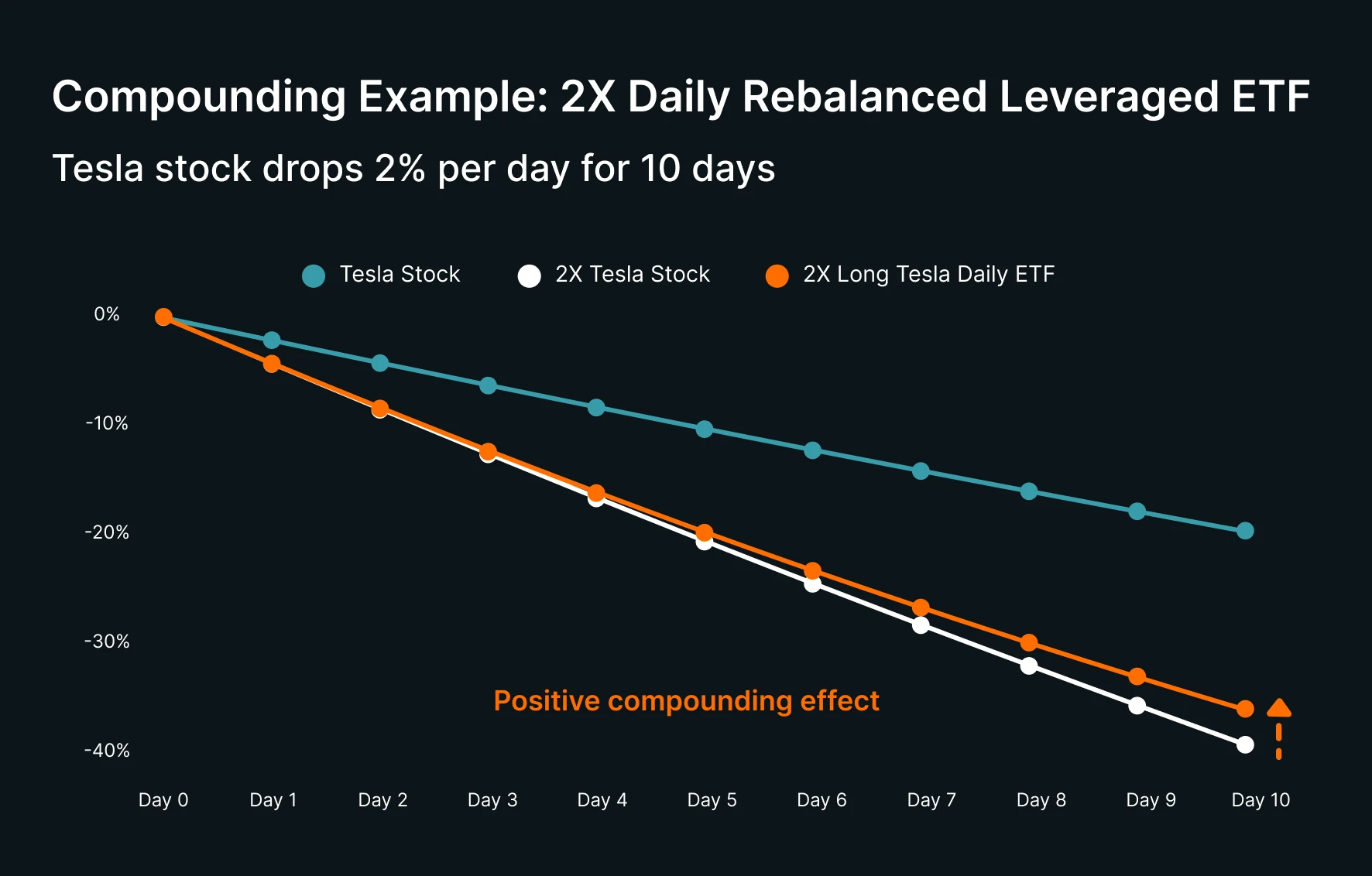

Tesla stock lost 18.3% after 10 days, which is less than the expected 20% loss from a 2% daily drop. That’s because each 2% drop applies to a smaller base each day. For the leveraged ETF, the compounding effect worked in your favor again: you lost slightly less than twice the loss on the stock.

Graphics are illustrative, shown before fees and expenses.

Example 3: Palantir oscillates between +2% and -2% daily for 10 days

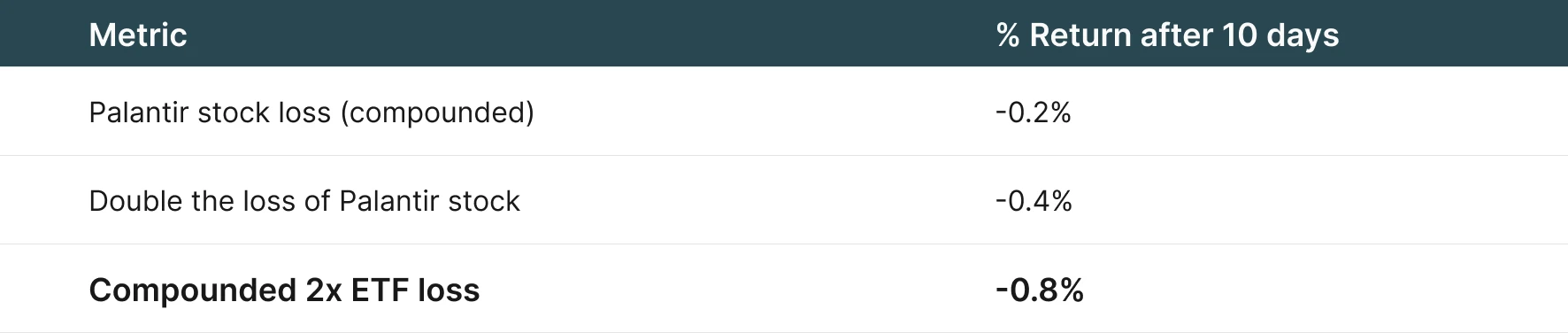

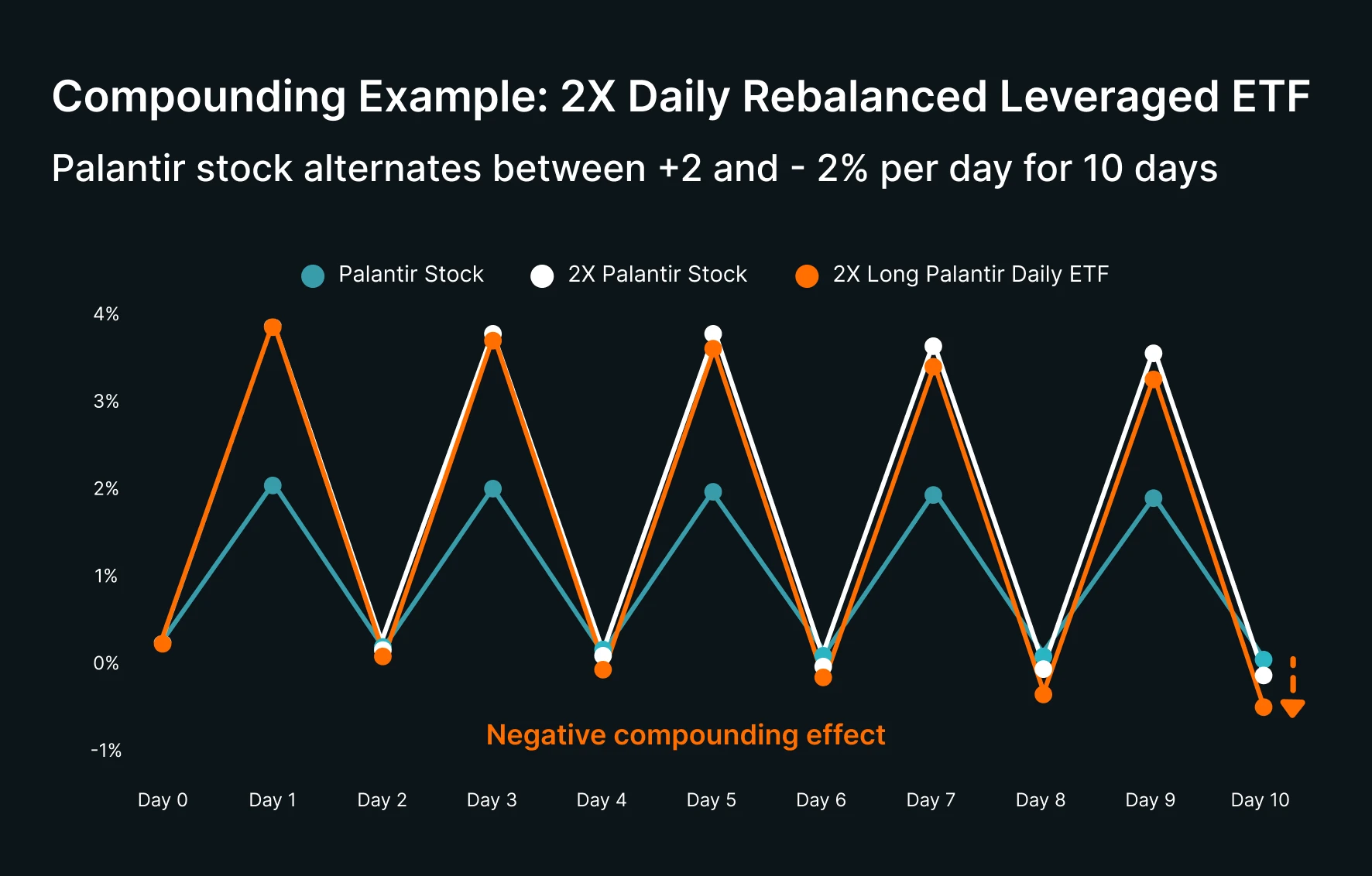

Stock prices don’t usually move up or down in a straight line – and that’s when compounding can have a negative impact. Now suppose Palantir oscillated between a 2% gain and a 2% loss each day. Here are the results using the Leverage Shares 2X Long Palantir Daily ETF (PLTG):

The stock would lose around 0.2% after 10 days because you compound each daily move to a slightly changing base. But the leveraged ETF would lose 0.8% – more than twice the loss of the stock. So in this case, the compounding effect of daily rebalancing works against the investor.

Graphics are illustrative, shown before fees and expenses.

This phenomenon is called volatility drag, where sideways or choppy markets can erode the value of leveraged ETFs over time. That’s why most traders typically only hold these ETFs for a day or less.

Key takeaways

Daily rebalancing keeps leveraged ETFs on target (e.g., 2X), but it also brings compounding risks into play over time.

In strong uptrends, compounding can boost returns, and leveraged ETFs may outperform.

In sideways or choppy markets, compounding and volatility drag erode returns – even if the stock doesn’t move much overall.

Leveraged ETFs are built for short-term moves, not long-term holds. Understanding how daily rebalancing works is key to managing risks and rewards.