Given that some analysts estimate1 that half of all AI infrastructure capital expenditures end up in the purchase of its products and services, American/Taiwanese chipmaker Nvidia Inc (ticker: NVDA) was expected to show pretty solid results for the second quarter (Q2) of its Fiscal Year (FY) 2026 that ended on July 31, 2025. While it did precisely that by delivering revenue: of $46.74 billion versus a LSEG-polled estimate2 of $46.06 billion and adjusted Earnings Per Share of $1.05 versus an estimate of $1.01, the stock’s price went on to show weakness in after-markets trading.

There are a number of factors behind this.

Trend Analysis

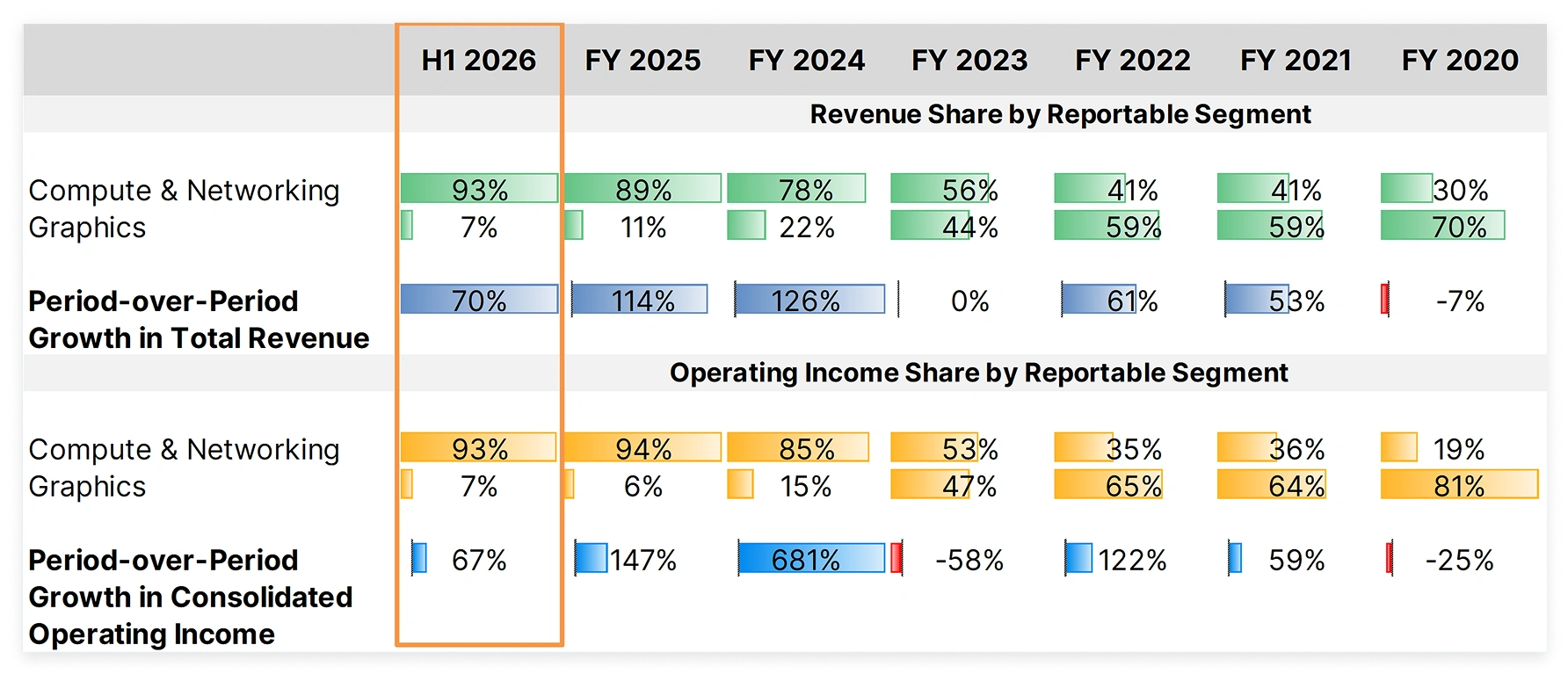

Across its product categories, the corporate-demanded “Compute and Networking” segment far eclipses the gamer/individual user favourite “Graphics” segment that dominated its revenue contribution in FY 2020.

Source: Company Information; Themes ETFs analysis, as of August 28, 2025

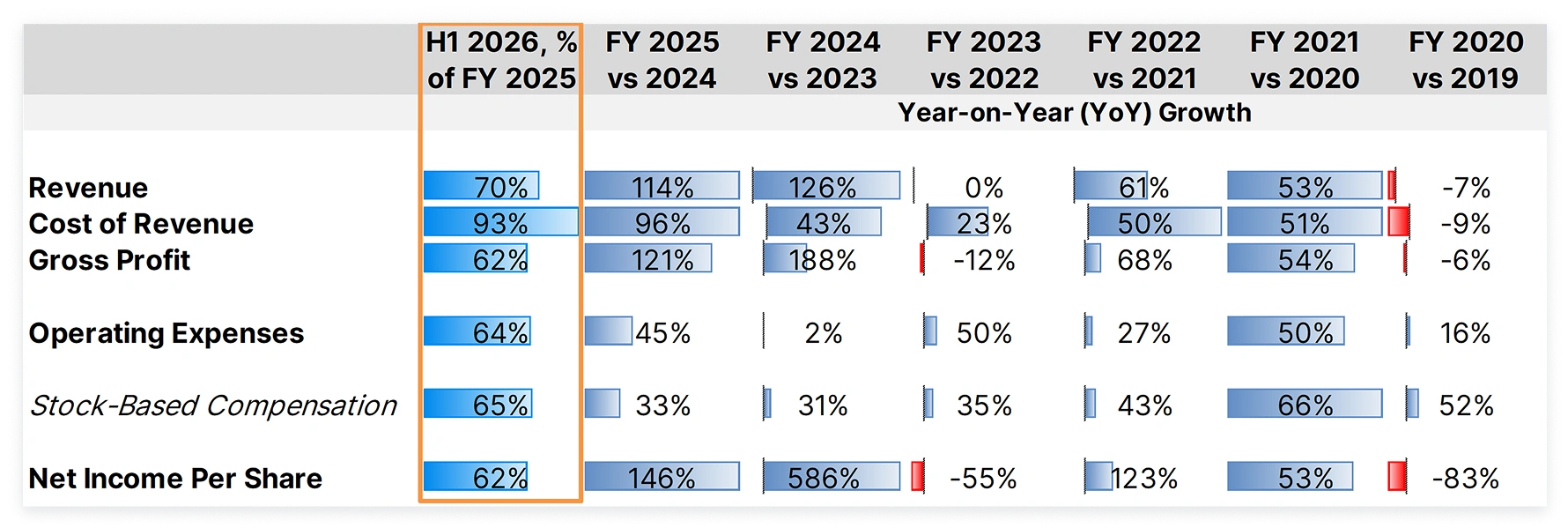

Despite this, growth in the first half (H1) of the company’s current fiscal year relative to FY 2025 is quite strong. The company’s total top and bottom-line trends are also quite strong.

Source: Company Information; Themes ETFs analysis, as of August 28, 2025

If trends continue, revenue for FY 2026 will be 40% higher than that in FY 2025 and net income will be 24% higher. This, however, is a significant stepdown from the triple-digit percentage growth seen over the last two FYs that led to the stock’s sky-high valuation. In the current FY, however, the stock has been very volatile, leading to the lowest potential growth in stock-based compensation expense in over six years.

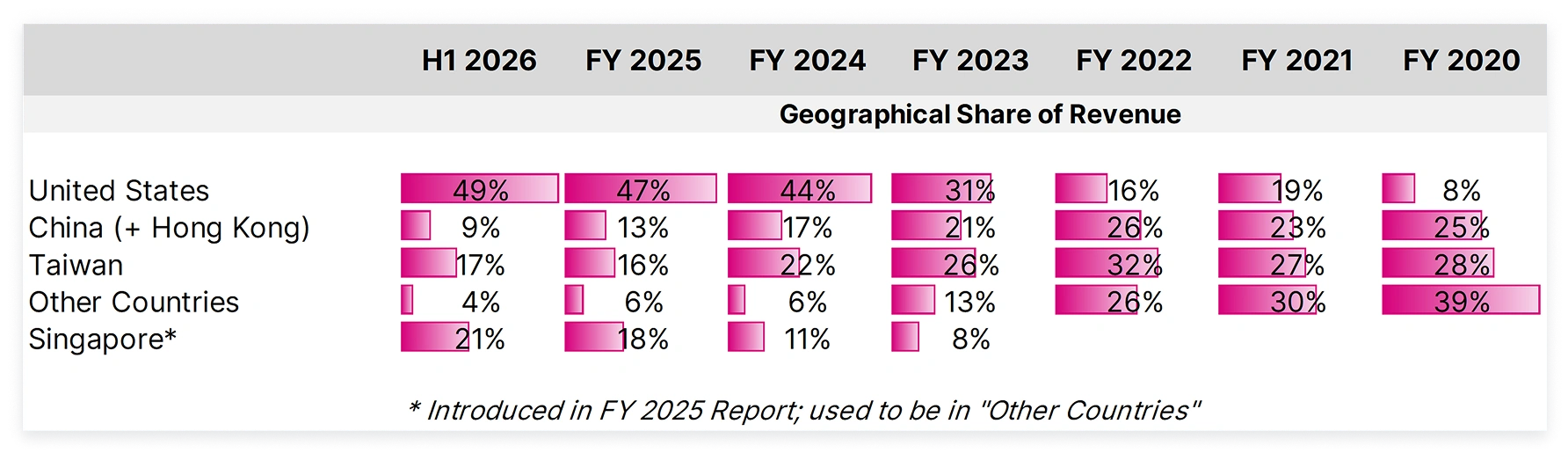

Another factor behind a dampened growth outlook is that Nvidia is increasingly less tapped into global growth in AI spending.

Source: Company Information; Themes ETFs analysis, as of August 28, 2025

As the company switched from a diversified product mix to a provider to corporations, revenue growth was more or less global for a while – notably through FY 2021 till FY 2022. But since then, other regions have fallen in revenue share with one exception: Singapore.

It was long suspected that Singapore was a re-export hub through which China was gaining access to technologies that were proscribed over the past two administrations. For its H1 2026 at least, the company states in its release that 99% of “controlled” products were purchased by U.S.-based customers. In its Q2, four direct customers accounted for 45% of all revenue earned.

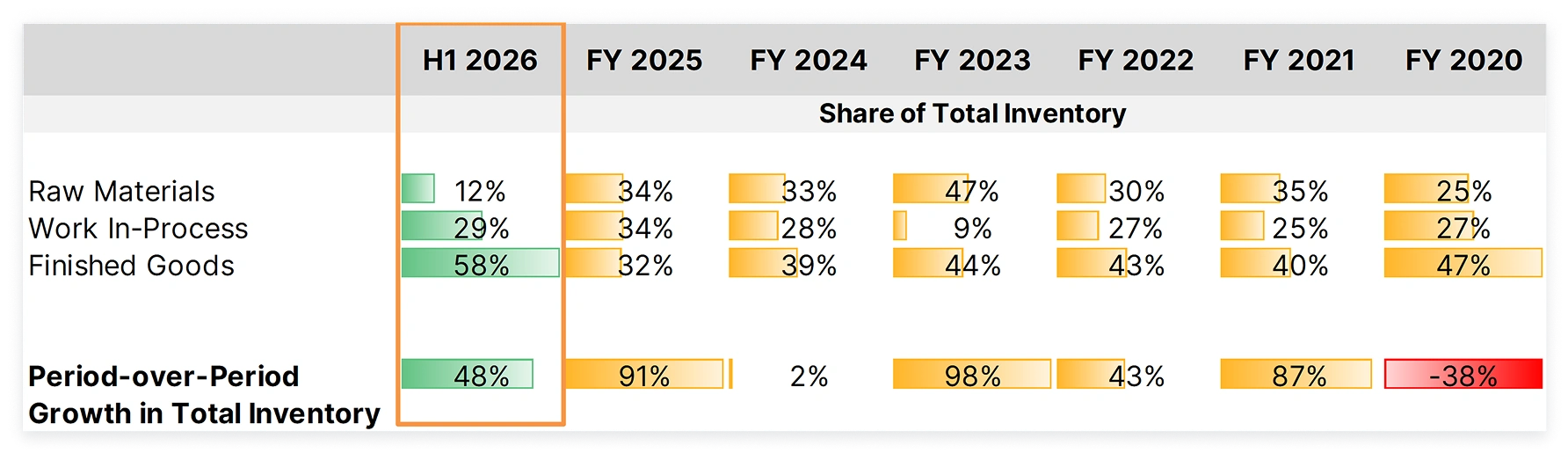

The company’s reported inventory numbers also highlight some interesting shifts.

Source: Company Information; Themes ETFs analysis, as of August 28, 2025

For most of the past six FYs, raw materials accounted for around a third of total inventory, indicating a steady forward-looking demand. As of Nvidia’s H1 2026, raw materials have seen a substantial shrinkage: this might be a warning bell.

The (Indirect) Trouble with Tariffs

Given that there are numerous companies – particularly in the East – that are building out national AI infrastructure with government support, the concentration of revenue sources is a concern for the company going forward. These companies are highly disincentivized from purchasing products of an American company (which Nvidia ostensibly is) towards the buildout of critical infrastructure. This is particularly true under “Trump Season 2”, i.e. Donald Trump’s second term in office.

Among the Eastern countries building out AI infrastructure, China and India lead the pack. While the administration expected to receive 15% of the revenue generated from licensed H20 sales, Nvidia reports that China’s purchases of H20 chips ground to a halt in its Q2. Instead, an “unrestricted” customer outside of China purchased $650 million of Nvidia’s H20 inventory. Furthermore, the company stated that the U.S. government hasn’t yet published a regulation codifying the 15% payout.

The idea of a 15% payout is, in itself, possibly indefensible. The original intent of the export control regime was to restrict China’s access to advanced technology. A 15% “tax” isn’t the same as a “restriction” ostensibly brought in to prevent the loss of intellectual property that was the basis behind the control regime. Considering that “Trump Season 1” initiated these restrictions and the subsequent Biden administration maintained it, the “tax” demand would be a reversal of stance that had bipartisan support in the legislature. Also, at a 15% level, the company likely wouldn’t make a profit (at best) or (perhaps) incur a loss – which means that Nvidia might have to exit the China market.

U.S. Commerce Secretary Howard Lutnick publicly stated3 that China would only get Nvidia’s “fourth best” chip and the plan was to “sell the Chinese enough that they get addicted to the American technology stack.” As it stands, the H20 is reportedly already surpassed by other chip design companies and the Chinese government, subsequent to Lutnick’s comments, told its tech companies to stop using H20 chips. Moreover, as DeepSeek’s early success despite the lack of top-of-the-line chips suggests, there is more than one way to crunch AI data: while Nvidia’s leading products offers a means to do it the hardware route, software- and code-driven optimizations are another demonstrable means of doing so with “older” and “less advanced” chips. The key determinant in choice is hardware availability and cost.

Next, India was referenced in a number of past earnings releases wherein the company stated that it was making inroads with local companies. With foreign-based computation resources deemed prohibitively expensive, the Indian government had recently allocated4 $1 billion in funding to kickstart native AI development ecosystems predominantly among small businesses and startups while including the buildout of a “national AI compute grid” within a country that already has 16% of the world’s AI workforce. A significant presence in this key market has been put paid by Trump’s tariff war on the country.

Now, the tariff hikes per se don’t presently5 impact India’s predominant exports to the U.S. – namely goods made of iron, steel, aluminum and copper; automobiles and related components; pharmaceuticals; petroleum products and electronics. However, the language employed by the President and his administration has created substantial rancour – which is especially true in the East wherein words are chosen and employed with care. It also tarnishes nearly 25 years of diplomatic and strategic outreach that began with the George W. Bush administration and subsequently raised to much higher levels with substantial bipartisan consensus. It is quite likely that India’s body politic, industries and populace don’t consider the U.S. to be a reliable trading partner anymore, with American companies also likely to face a distinct cooling off in its fostered relations going forward.

As of on the 29th of August, the Indian Prime Minister is visiting another of India’s historic and esteemed trading partners: Japan. A number of agreements in the areas of semiconductor manufacturing and AI6 along with a “talent-exchange” program that will see 500,000 professionals7 being granted work opportunities in each other’s countries over the next five years.

These moves currently in play by two major Eastern powers that don’t see eye to eye on all matters – with India, in particular, historically being a strategic partner for the U.S. against China – are being executed independently and in alignment with their own interests. These have long-term consequences for American companies that need a global market base with no substantial incentive to have them replaced. Through the current administration’s behavior, there is now an incentive.

Overall, these externalities effectively impair the long-term growth outlook for Nvidia despite its best efforts and through no fault of its own. However, “tech” is effectively considered the next best thing to U.S. Treasuries (and for some investors, even preferable to) in a market with increasingly low breadth. While Nvidia won’t expect a precipitous market drop, it is increasingly less a “global” force and more an “American” one. Over the next FY or so, growth can be expected to progressively lower.

With time, being “American” wouldn’t necessarily mean a “world leader” and this would be particularly true in strategic industries such as the one Nvidia inhabits. Bouts of bearishness in the stock can be expected going forward, although low market breadth could possibly create some support.

Footnotes:

1Nvidia to report earnings amid infrastructure spending, DeepSeek concerns”, CNBC, 25 February 2025

2“Nvidia beats on top and bottom lines as company expects breakneck AI spend to continue”, CNBC, 27 August 2025

3“China Warns Against Nvidia H20 Chips: Here’s Why That Won’t Stop the AI Leader”, Yahoo! Finance, 25 August 2025

4“Building India’s own AI infrastructure: From consumers to creators”, Economic Times, 10 June 2025

5“Indian goods won’t face 50% US tariffs if these three conditions are met”, Hindustan Times, 26 August 2025

6“Japan to unveil plan to invest $68 bn in India over 10 years in AI, chips”, Business Standard, 26 August 2025

7“Japan, India arranging to agree on exchange of over 500,000 people over 5 years”, NHK Japan, 27 August 2025