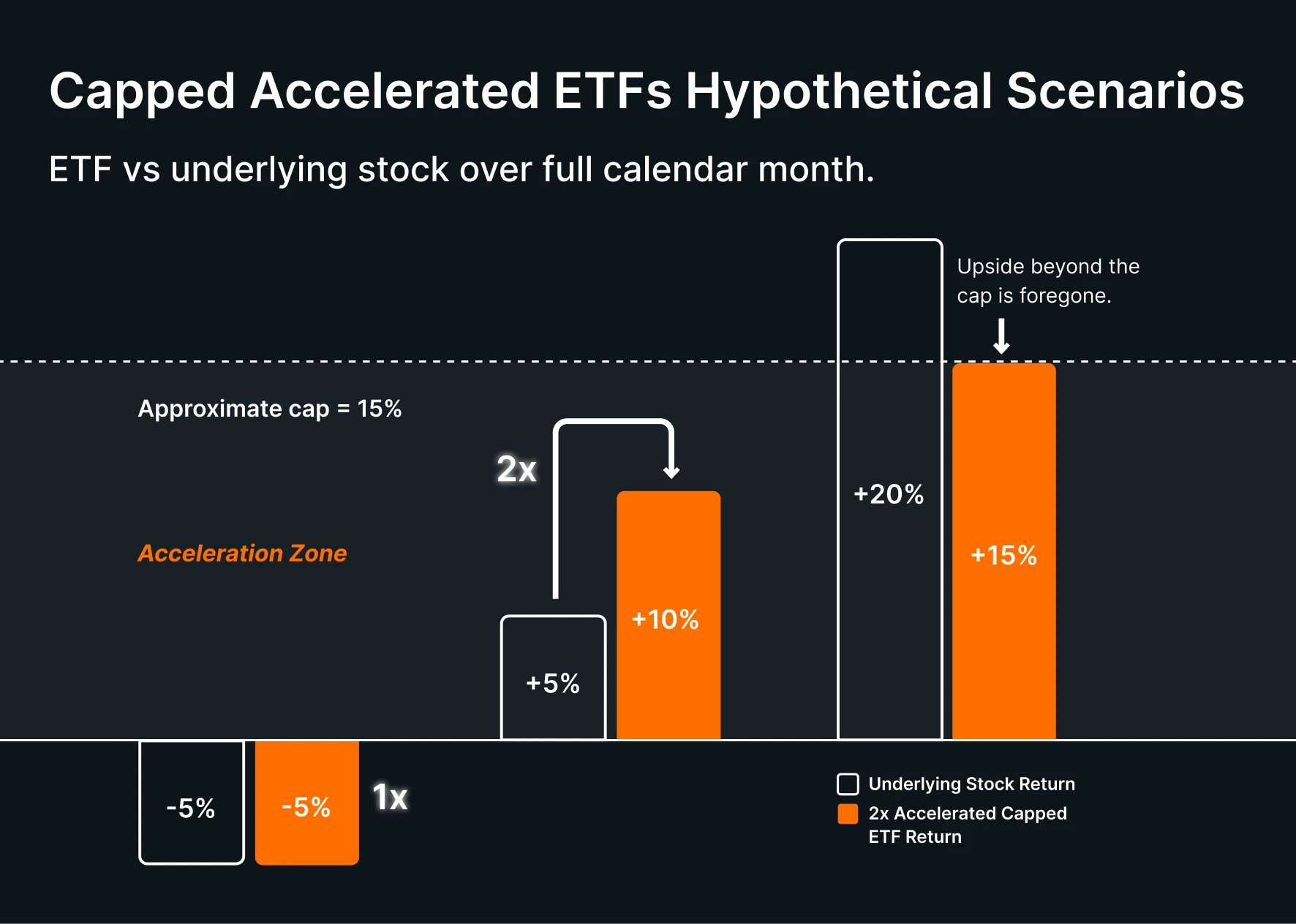

Leverage Shares capped accelerated ETFs aim for twice the upside of an underlying stock over a month – up to a fixed “cap”. And if the stock goes down over the month, they aim to match the stock’s losses one-for-one.

This article explains how these ETFs work, along with their potential risks and benefits.

What are capped accelerated ETFs?

A capped accelerated ETF is an exchange-traded fund that doesn’t hold any stocks. Instead, it buys and sells options on a stock to target a specific payout over one month, before fees and expenses:

If the stock rises: the ETF aims to double the stock’s gain until it reaches the monthly upside cap.

If the stock falls: the ETF aims to drop as much as the stock, with no downside cap.

The payout assumes you buy the ETF at the start of the month and hold it until the end. That’s because the fund builds its options strategy to match a single calendar month. The strategy can only line up as intended if you hold the ETF for that full period.

The cap is the maximum return the ETF can achieve in a full month. It resets each month based on two main factors: options market prices and implied volatility (the market’s expectation for how much a stock might move).

Graphics are illustrative, shown before fees and expenses.

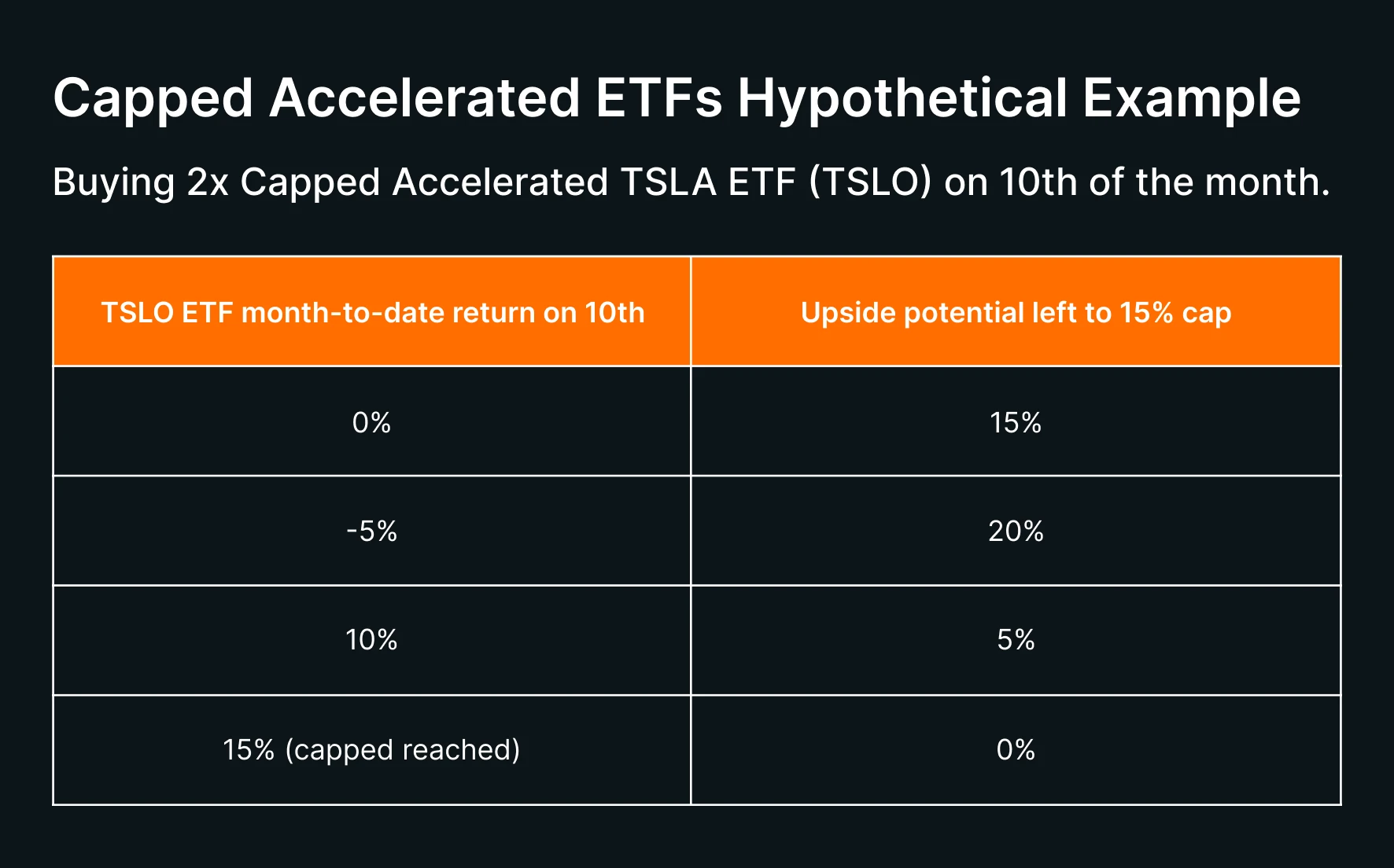

What if you buy the ETF during the month?

You can trade the ETF on any trading day during the month – just like a regular ETF. If you buy the ETF intra-month, the return potential depends on where the ETF trades at that point:

If the fund is down so far: you have more upside potential left until it reaches the fixed cap.

If the fund is up so far: you have less upside potential left to the cap.

Let’s use a hypothetical example to explain the concept. Assume the 2x Capped Accelerated TSLA ETF (TSLO) has a monthly cap of 15% – and you buy the ETF on the 10th of the month.

At that point, the ETF might be flat for the month, leaving the full 15% upside potential. It could also be down 2%, which would increase the remaining upside to 17% (15% plus 2%). If the ETF sits closer to +10%, then only 5% remains before the cap. And once the ETF already reaches 15% for the month, the upside is done for the month.

Graphics are illustrative, shown before fees and expenses.

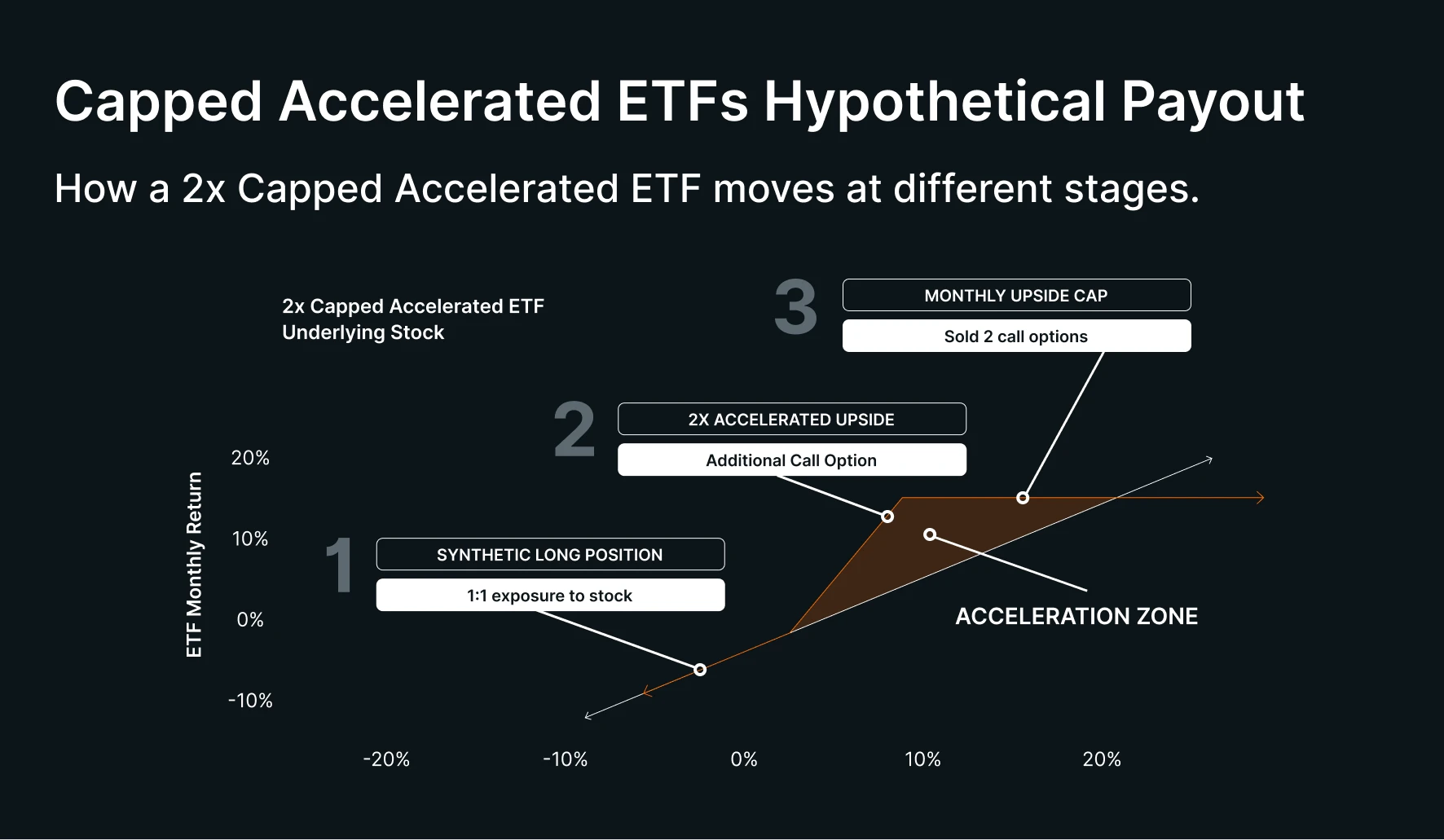

If you buy a capped accelerated ETF intra-month, you should understand the acceleration zone. When the ETF trades below the zone, it tracks the stock one-for-one. Inside the zone, the ETF delivers about double the stock’s gains. And once the ETF hits the cap, it stops rising and no further upside remains for the month.

Because of this acceleration zone, buying mid-month isn’t as simple as “checking the stock price”. What matters is where the ETF itself already sits relative to the cap. We publish the remaining monthly caps for our ETFs daily on our website, and we also share weekly updates on LinkedIn and X.

Graphics are illustrative, shown before fees and expenses.

How does the options strategy work?

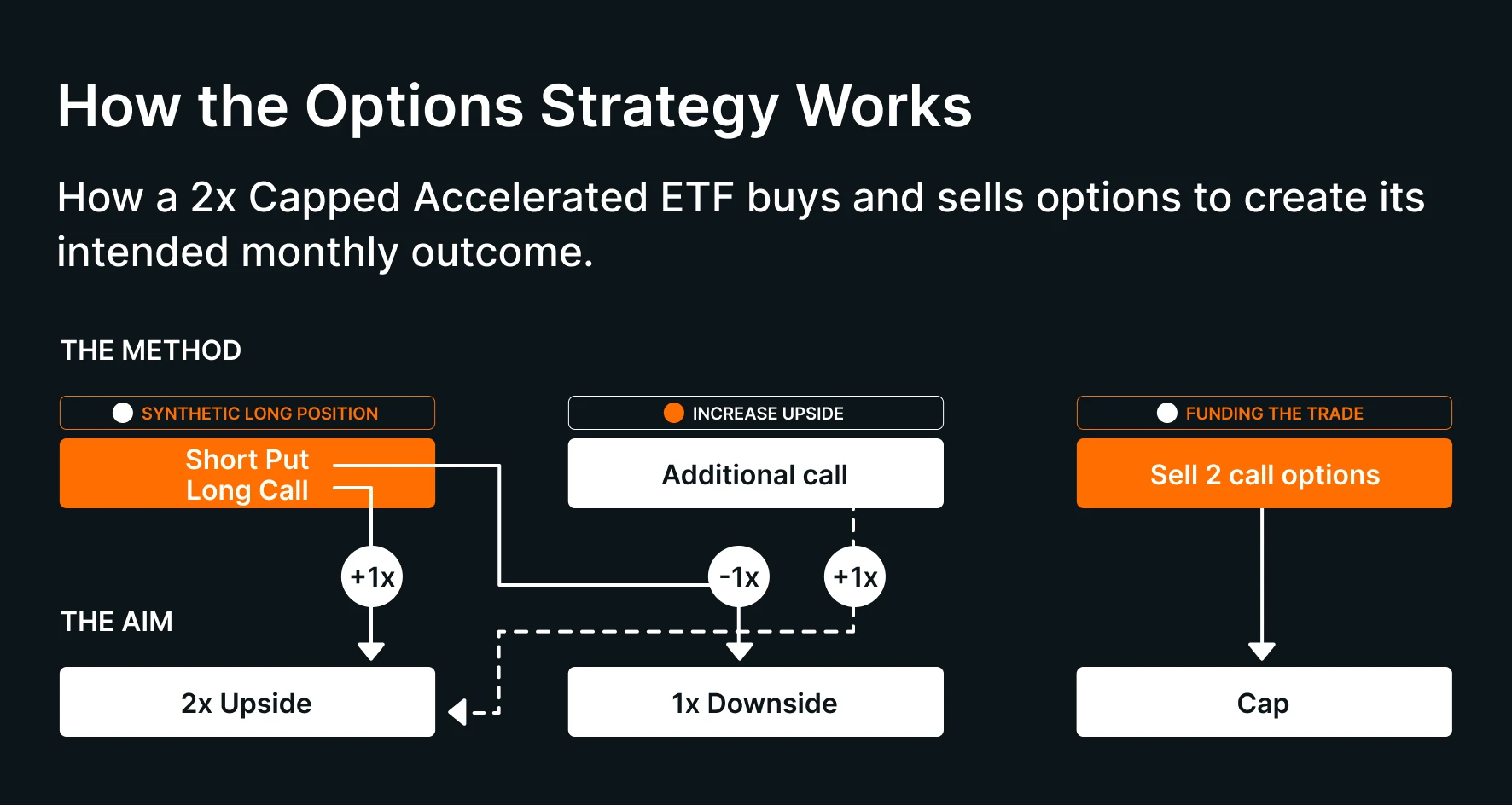

The monthly payout, acceleration zone, and cap all come from the options strategy inside the ETF. Here’s how it works in three steps:

Step 1 – Build stock-like exposure: The ETF combines a short put option with a long call option. Together, these options act like owning the stock itself – without actually owning it. That gives the fund one-for-one exposure to the stock’s moves.

Step 2 – Add extra upside: The ETF then buys another call option. This creates the acceleration zone, where the ETF can deliver about twice the stock’s gains until it reaches the cap.

Step 3 – Fund the trade: To pay for the extra call, the ETF sells two other call options at higher strike prices. These sold calls aim to generate income, but they also create the cap.

Graphics are illustrative, shown before fees and expenses.

Putting all the pieces together, the intended result of the capped accelerated options strategy is:

The ETF tracks the stock on the downside.

It aims to double the stock’s gains within the acceleration zone.

Once it hits the cap, the upside stops for that month.

Remember, the Capped Accelerated ETF strategy is designed to play out over a full monthly cycle. Options lose value as time passes, and their prices change with market volatility. The ETF resets its options at the start of each month. That’s why the payout can only line up if you hold it from the first day to the last.

You can view the full series of Leverage Shares Capped Accelerated ETFs here.

FAQs

Can you trade these ETFs during the month?

Yes. They trade daily like regular ETFs.

Do fees affect returns?

Yes. All performance is shown gross of fees. Actual returns will be lower once fees and expenses are applied.

Can the ETF lose more than the stock?

The downside exposure is designed to approximately match the stock one-for-one.

Why does the cap change every month?

The cap changes because option costs, volatility, and other market conditions change.

What happens if you hold for multiple months?

Each month resets with a new cap. Holding longer than a single month may result in performance that diverges significantly from the underlying stock.

Who are these ETFs designed for?

They are intended for tactical investors who want defined, short-term upside participation with capped gains. And who can tolerate full downside risk.

Key takeaways

Capped Accelerated ETFs aim for about twice the monthly upside of a stock, up to a fixed cap. They also aim for with one times the downside if the stock falls during the month.

The fund resets the cap every month, based on options pricing and volatility.

If you invest intra-month, you may capture more or less of the cap – depending on where the fund is trading at the time.