Capped accelerated ETFs buy and sell options to target a defined payout over a full month. But what if you buy them during the month? That can create short-term opportunities or bring additional risks – especially around market events like earnings reports, Federal Reserve press conferences, and TACO tweets. This article explains how capped accelerated ETFs might work in each scenario.

1. Company earnings reports

Company earnings reports could cause added stock price volatility. The market expects certain numbers – and if those numbers differ, the stock may move fast in either direction. For example, suppose Nvidia reports earnings mid-month, and the results miss analyst expectations. Its stock price then drops 6% after hours, leaving it 5% down for the month.

How might this drop affect the 2x Capped Accelerated NVDA ETF (NVDO)?

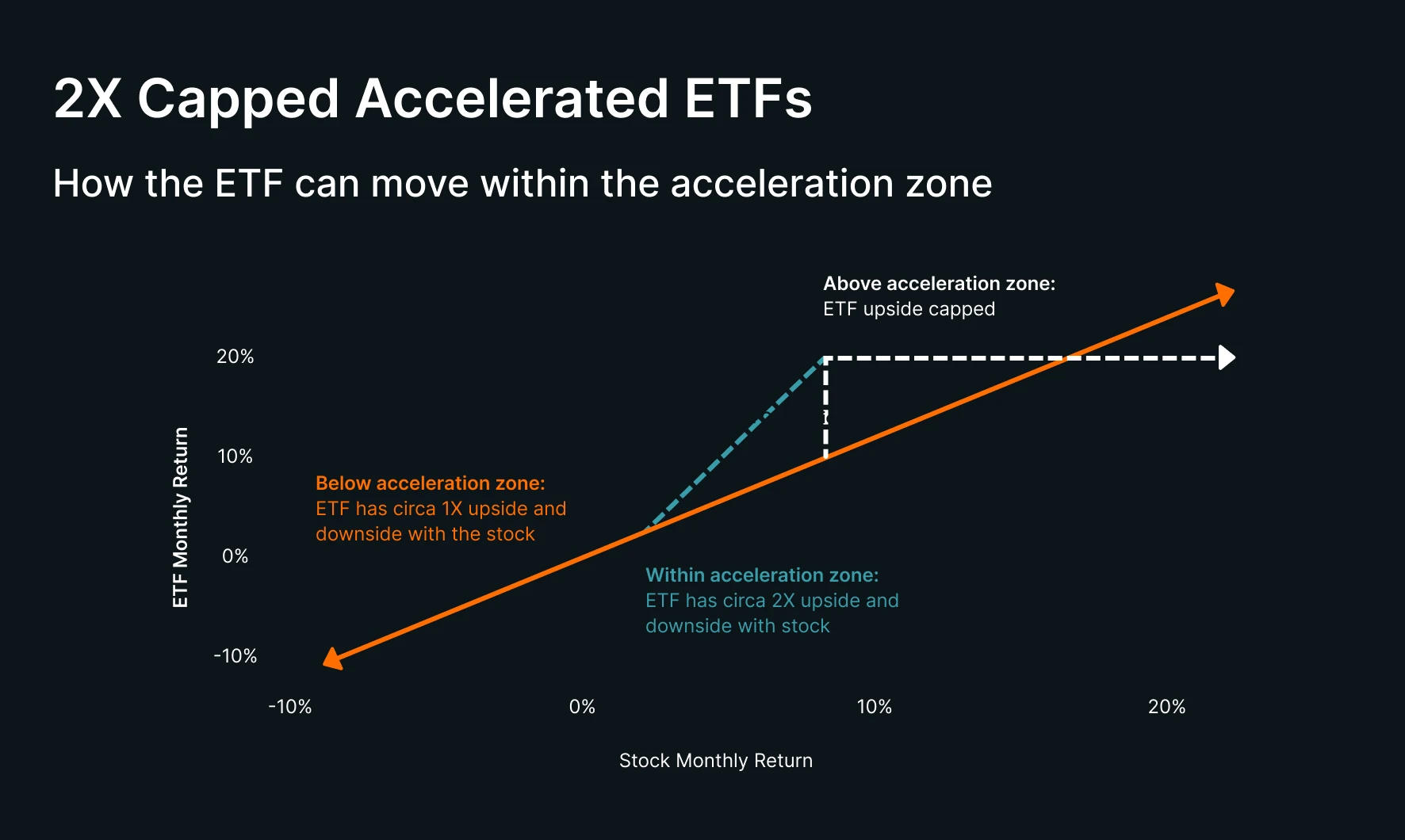

A capped accelerated ETF aims to roughly double the upside of a stock over a full month (before fees and expenses). But that upside is capped to a fixed level each month. If the stock goes down over the month, it aims to match the stock’s losses approximately one-for-one.

So in this example, the 2x Capped Accelerated NVDA ETF (NVDO) would also drop to some amount after the Nvidia earnings announcement. To keep the numbers simple, let’s assume the ETF also drops to minus 5% (like the stock).

If your analysis suggests the market overreacted to Nvidia’s results, that could create a potential opportunity. If the monthly cap is 15%, but NDVO is now down 5%, there would now be 20% left to the cap. Since the cap is now further from your entry price, there’s more upside potential left for the month.

Side note: because capped accelerated ETFs run options strategies over a full month, the day-to-day link with the stock isn’t exact. These examples are only hypothetical and are just to explain the concept. We publish the remaining monthly caps for our ETFs daily on our website, and we also share weekly updates on LinkedIn and X.

2. Fed press conferences

When Jerome Powell says “Good afternoon” at a Federal Reserve press conference, traders brace themselves for volatility. From his first words, markets can jump, dive, or both within minutes. Suppose MicroStrategy stock drops 3% while Powell speaks. Some investors think the Fed has turned cautious, while others see a knee-jerk overreaction.

How could this impact the 2X Capped Accelerated MicroStrategy ETF (MSOO)?

If you think the market has overreacted, you might view that drop as an opportunity. Buying MSOO while it’s down intra-month leaves more upside potential to the cap. But if the fund is already up for the month, it could sit inside or above the payout “acceleration zone”. That means if the stock keeps falling, the ETF can drop faster – about twice the stock’s fall – while in that zone.

So the acceleration zone is generally where more risks lie. The ETF aims to deliver about twice the stock’s gains until it reaches the cap (when the acceleration zone ends). But that could also mean double the losses if the stock price moves down within the zone.

Graphics are illustrative, shown before fees and expenses.

Side note: Learn more about the acceleration zone in our capped accelerated ETF PDF guide.

3. The TACO trade

“TACO” stands for “Trump Always Chickens Out”. The phrase gained traction in May 2025 after markets reacted to the president's tariff threats and reversals.

Now suppose Palantir drops 5% with renewed tariff talk mid-month. The 2X Capped Accelerated Palantir ETF (PLOO) would also drop in that case. If the monthly cap is 15%, that fall now leaves 20% potential upside to the cap for the rest of the month.

If you think it’s TACO time, that could be an opportunity. But remember: if Palantir is already positive for the month, PLOO could sit inside its acceleration zone. That means short-term losses may move faster too – up to twice the stock’s drop.

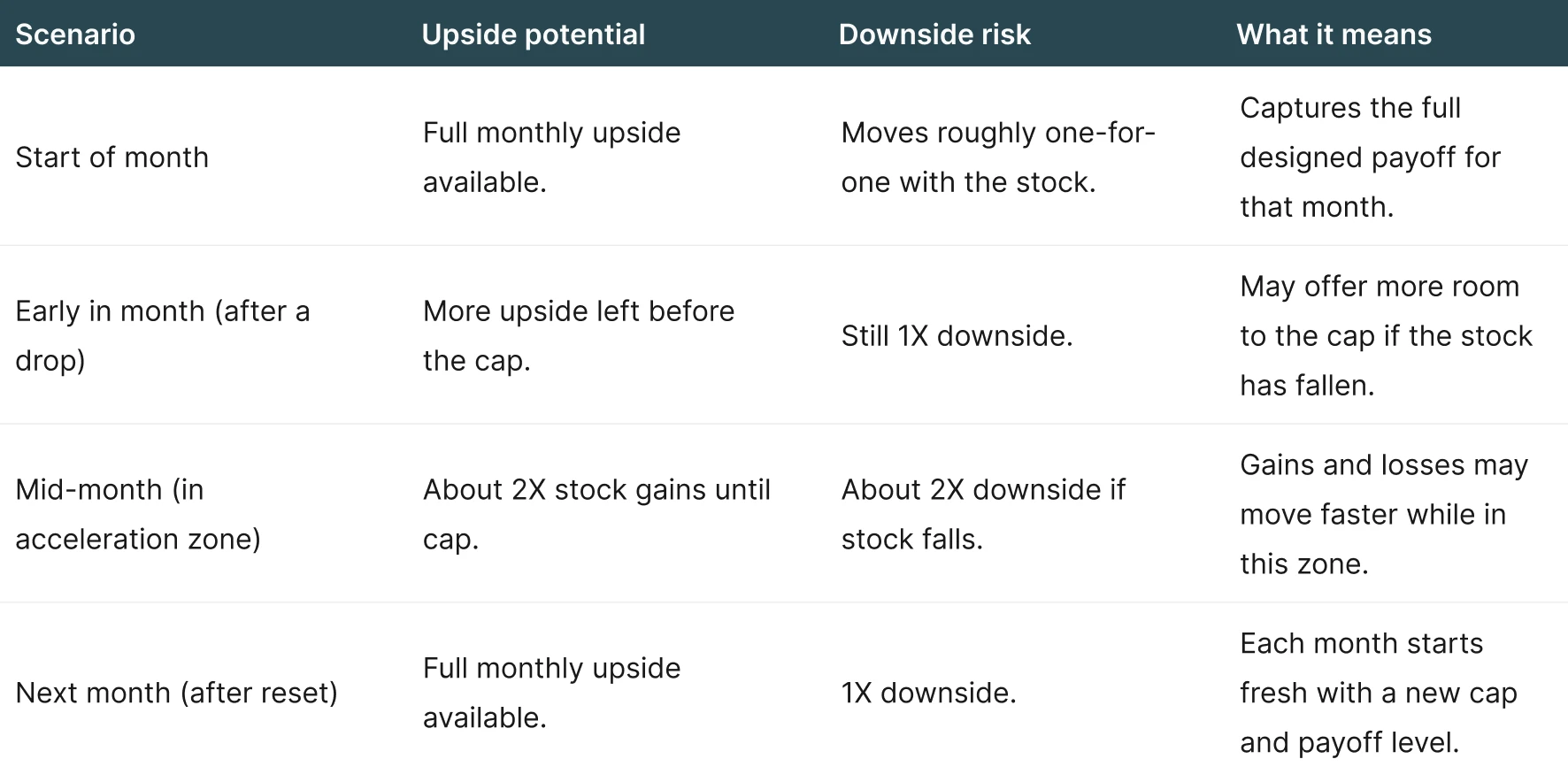

The table below summarizes how a 2X Capped Accelerated ETF may move at different stages of the month, depending on market events:

Read this article to learn more about how capped accelerated ETFs work.

Key takeaways

Buying into a capped accelerated ETF during the month could change the fund’s remaining upside and risk.

Inside the “acceleration zone”, gains and losses may move roughly twice as fast as the underlying stock.

Monthly caps reset each month - you can view daily remaining caps on our website.