Robinhood Markets stock has experienced a sharp pullback recently. As investors have moved away from growth and momentum stocks, it has fallen out of favor. However, recent Q4 earnings1 showed that the company is still growing at a prolific rate, and continues to have big ambitions for the future. Here are some highlights from the Q4 report, and a look at analysts’ reactions to the print.

27% Revenue Growth in Q4

For the fourth quarter of 2025, Robinhood’s total net revenues amounted to $1.28 billion, an increase of 27% year over year. Breaking this top-line figure down, transaction-based revenues were up 15% to $776 million, net interest revenues were up 39% to $411 million, and other revenues were up 109% to $96 million.

Zooming in on transaction-based revenues, the highlight was ‘other’ transaction revenue – which includes revenue from prediction markets and securities lending – which came in at $147 million, up over 300% year on year. However, options revenue ($314 million, +41% y/y) and equities revenue ($94 million, +54% y/y) were also very strong. On the downside, cryptocurrencies revenue was down 38% to $221 million, hurt by the weakness in crypto markets.

In terms of profitability, net income for the quarter was $605 million compared to $916 million in Q4 2024. However, the Q4 2024 figure included a $424 million boost from a Tax Benefit and Regulatory Accrual Reversal. Diluted earnings per share was $0.66 (above the consensus forecast of $0.602) compared to $1.01 in Q4 2024. However, the prior-year figure included a $0.47 benefit from the Tax Benefit and Regulatory Accrual Reversal.

68% Growth in Total Platform Assets

Looking beyond the revenue and earnings figures, total platform assets increased 68% year over year to $324 billion, driven by continued net deposits, acquired assets, and higher equity valuations. Meanwhile, funded customers increased 7% year over year to 27.0 million.

On the subscription side of the business, the number of Robinhood Gold subscribers increased by 58% year over year to 4.2 million. This resulted in Robinhood Gold subscription revenue of $50 million, up 56% year on year.

Turning to trading volumes, equity notional trading volumes increased 68% year over year to a record $710 billion while options contracts traded increased 38% year over year to a record $659 million. Event contracts traded were a record 8.5 billion, up from 2.3 billion in the third quarter of 2025.

Earnings Call Insights

On the earnings call2, CEO Vlad Tenev talked about how Robinhood is aiming to be a financial “super app.” To achieve this, it is looking to transition from predominantly serving traders to serving all of its customers’ financial needs. Currently, it is rolling out a range of additional services including banking (it now has 25,000 funded customers here who have brought in over $400 million in balances), a social-networking platform, private markets investments (packaged in registered funds that are offered to US retail investors), and a referral program for advisors. The company believes that these additional services will enable it to be a major beneficiary of the $100 trillion+ wealth transfer.

Looking ahead, the company is also aiming to build the number one global financial ecosystem. Here, the key theme is “tokenization.” 24/7 tradable public company stock tokens are one type of product the company sees significant potential in. Private company stock tokens are another.

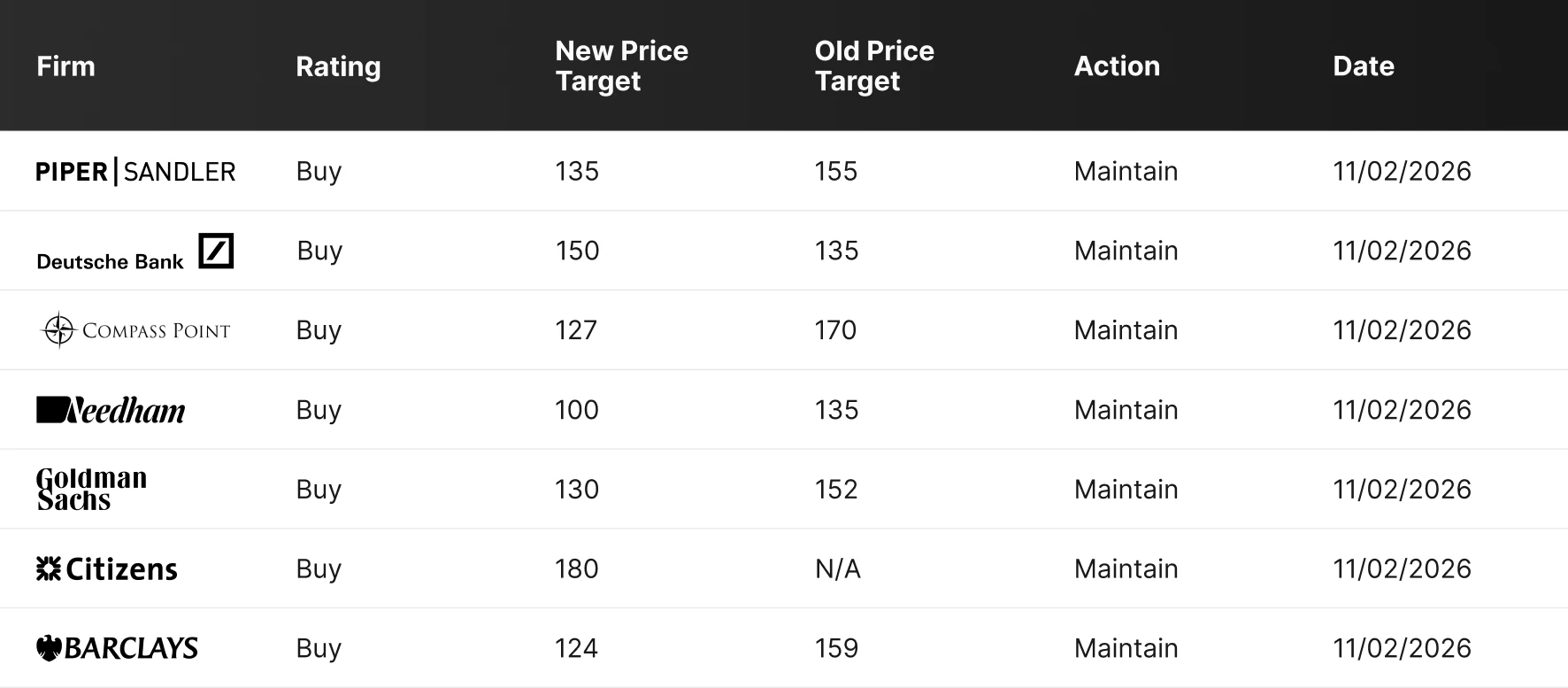

HOOD Stock Price Targets

After Robinhood’s Q4 earnings, a number of analysts3 reiterated their “Buy” ratings for the stock. However, it’s worth pointing out that several firms lowered their price targets.

Most price targets remain well above the current share price though. Currently, the average price target is $146 – almost double the current share price.

Footnotes:

1Robinhood Reports Fourth Quarter and Full Year 2025 Results, as of February 10, 2026

2Investing.com, Earnings call transcript: Robinhood Q4 2025 sees record revenue, EPS beat, as of February 10, 2026

3Investing.com, Robinhood Markets Inc (HOOD), as of February 10, 2026