Leveraged ETFs aim to give investors amplified exposure to daily market moves – without needing margin accounts. They may suit experienced traders who want short-term, tactical exposure to an index, stock, or other asset. This guide explains what leveraged ETFs are, how they work, and their potential risks and benefits. It also covers fees, daily rebalancing, and compounding, and how these funds compare with traditional exchange-traded funds.

What are leveraged ETFs?

A leveraged ETF is an exchange-traded fund that aims to multiply the daily return of an underlying index or asset. Common targets are 2x or 3x the day’s price move. Unlike traditional ETFs, leveraged ETFs don’t usually hold the securities directly. Instead, they typically use derivatives like total return swaps with counterparties to reach the stated leverage.

A swap lets the fund exchange cash flows based on the underlying asset’s daily return. That creates leveraged exposure without owning the asset. It also makes it easier for the fund to reset exposure back to the target leverage multiple each day.

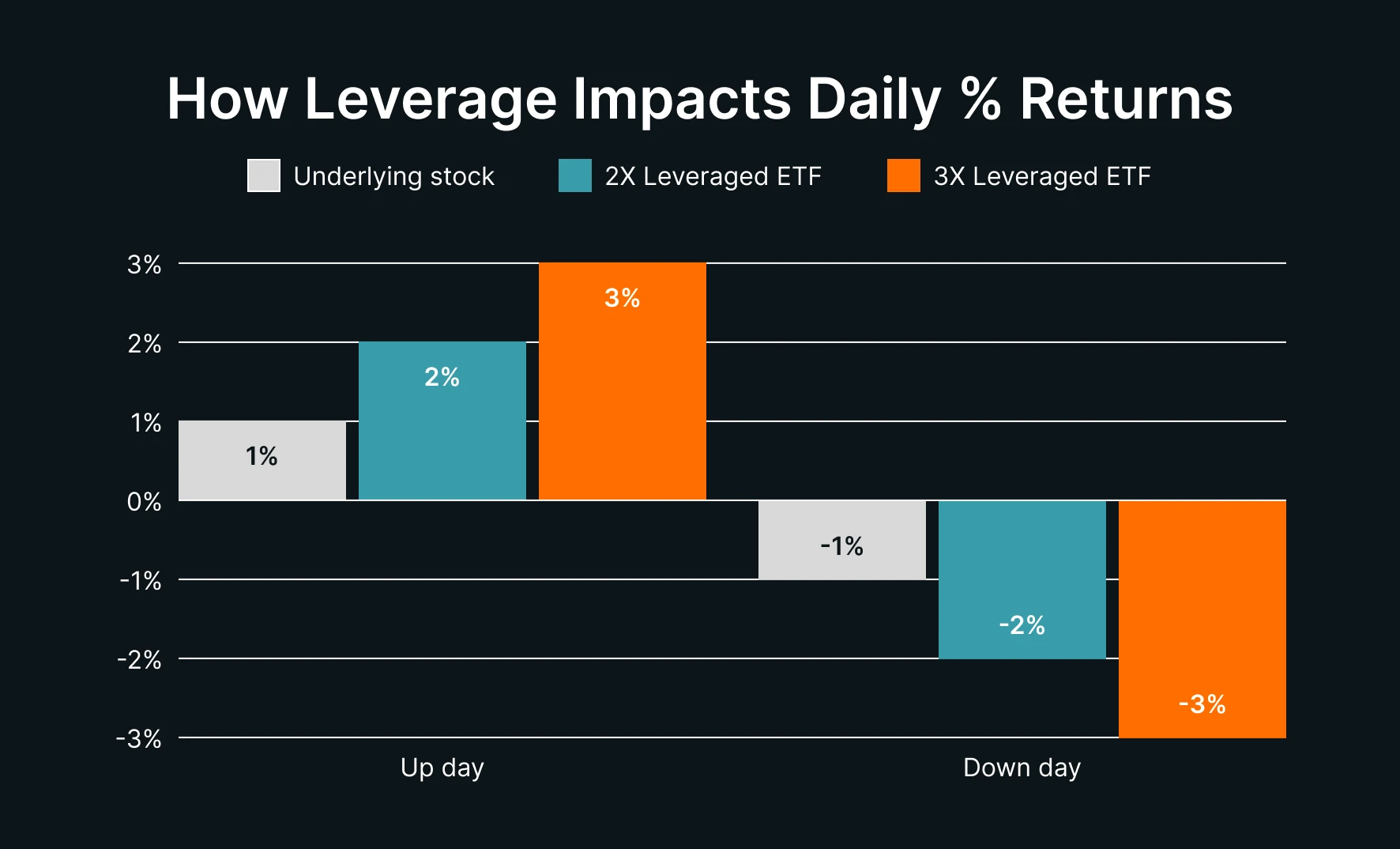

Magnified returns can raise the reward potential – but also the risk. Small moves can produce large gains or losses when leverage is involved.

Graphics are illustrative, shown before fees and expenses.

How do leveraged ETFs work?

The goal is to deliver the daily target multiple return before fees and costs. For example, if the index rises 1% today, a 2x fund aims to rise about 2% today. If the index falls 1% today, a 2x fund aims to fall about 2% today.

To do that, the fund holds cash or collateral and uses swaps to scale exposure up to the desired multiple. At the end of each trading day, it rebalances back to the target leverage. That daily reset keeps tomorrow’s leverage on target – and it introduces “compounding effects” if you hold longer than a day. More on compounding later.

Because exposure is reset daily, a leveraged ETF won’t simply deliver “2x or 3x” over weeks or months. The path of returns also matters. Trends and volatility change the outcome.

2x Leveraged ETF: a worked example

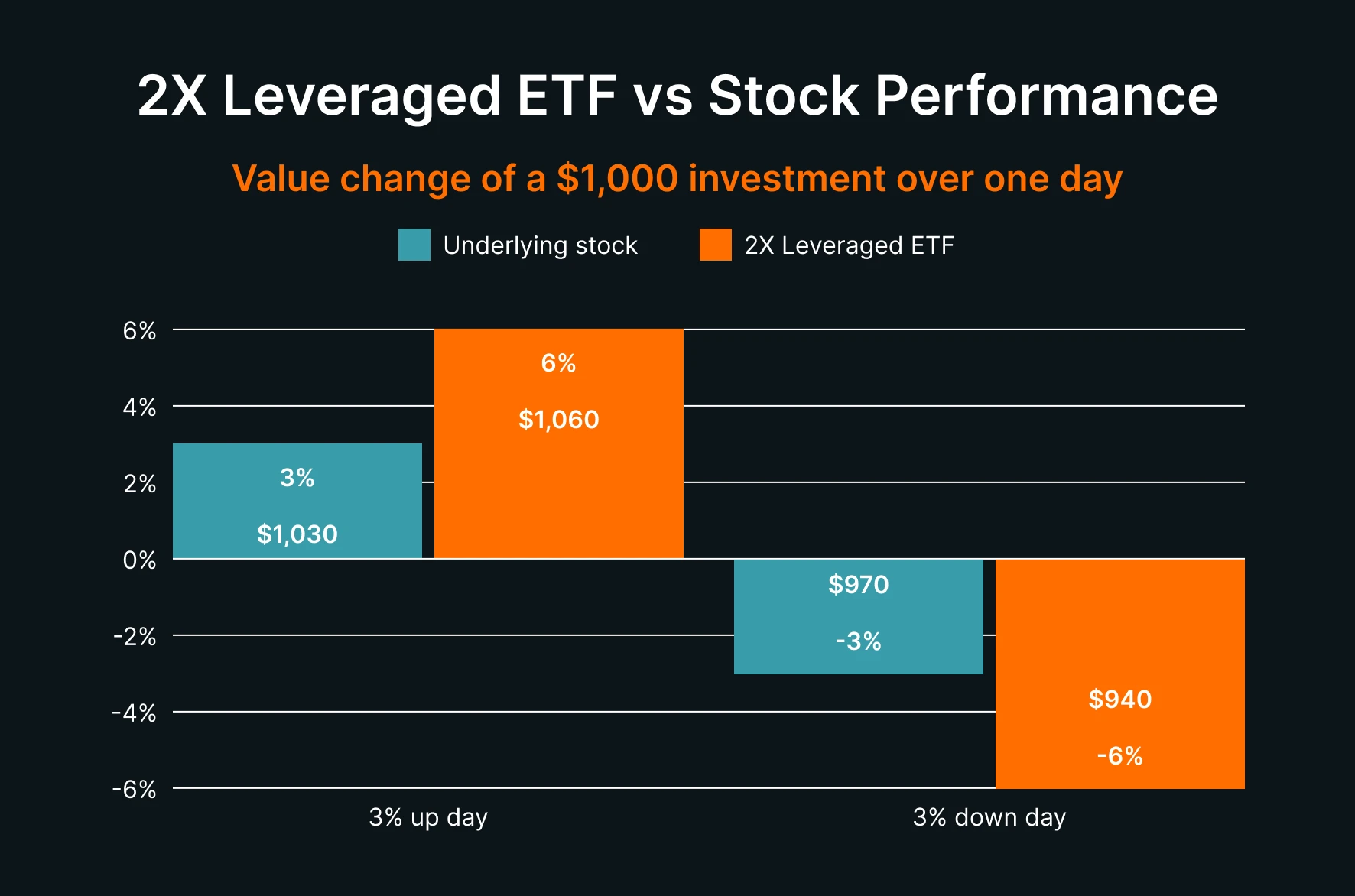

A 2x leveraged ETF tracks a stock. If the stock rises 3% in a day, the ETF aims for about +6% that day. If the stock falls 3%, the ETF aims for about –6%. Leverage works both ways: daily gains may double, but so could daily losses.

Now, assume you invest $1,000 in the ETF. A 3% move higher for the stock might take your position to about $1,060 (6%). On the other hand, a 3% move down might take it to about $940 (-6%). That is the appeal and the trade-off. You get magnified exposure to today’s move.

Graphics are illustrative, shown before fees and expenses.

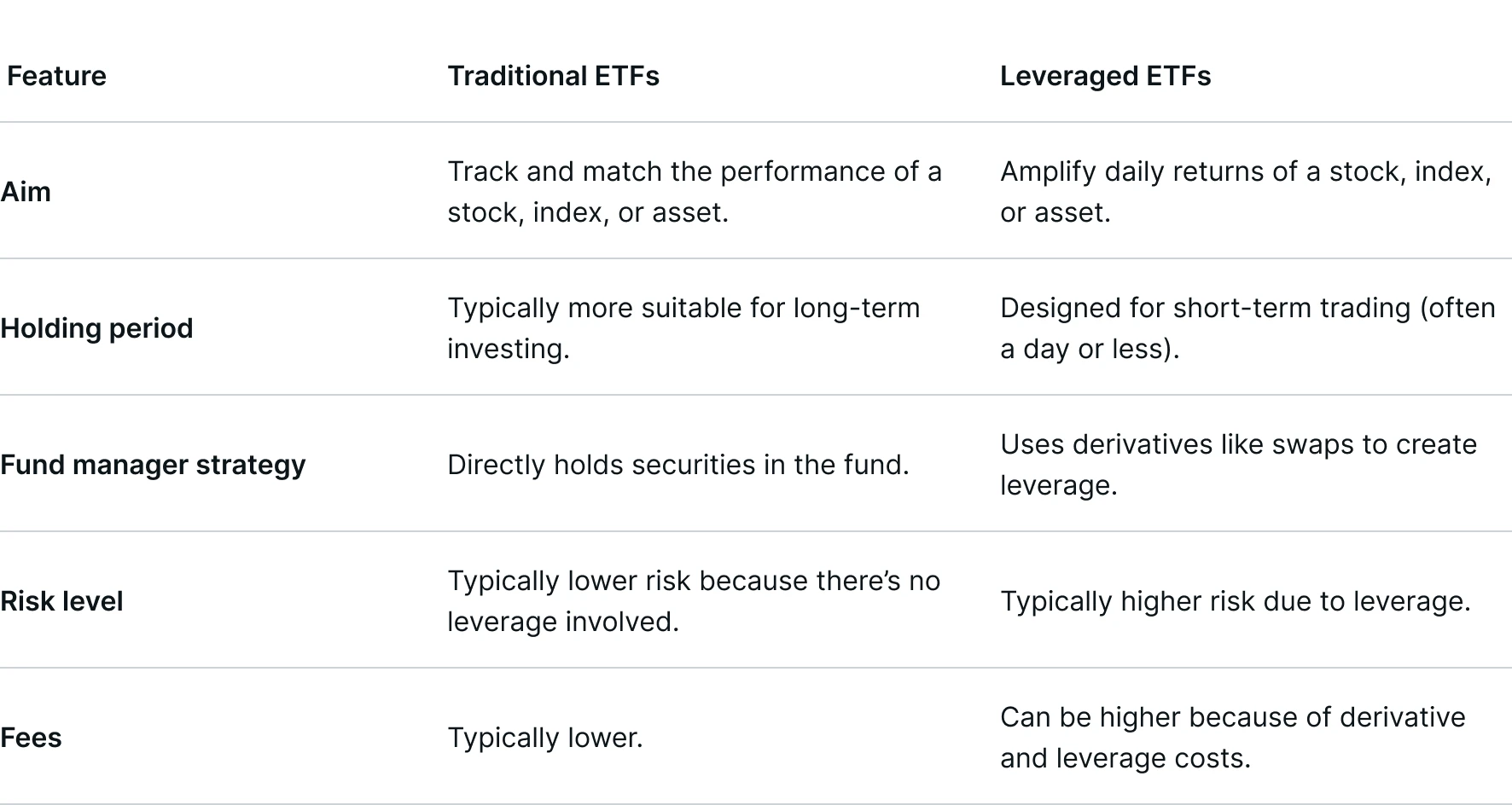

Leveraged ETFs vs traditional ETFs

Traditional ETFs track an index or asset by directly holding the underlying securities. They’re usually designed for long-term investors who want low-cost, diversified exposure to a particular investment or sector. Their prices generally stay close to the fund’s NAV because of a process called creation and redemption.

Here’s how that works. Large market firms called authorised participants (APs) can deliver a set of the underlying securities to the ETF in exchange for new shares. That’s called creation. They can also return ETF shares to the issuer and take back the underlying securities. That’s called redemption. If the ETF’s market price drifts away from its NAV (net asset value), APs step in to create or redeem shares. This process helps keep the ETF’s price close to its NAV.

Leveraged ETFs follow the same creation and redemption process, but the assets inside the fund are different. Instead of holding the securities directly, leveraged ETFs use swaps with counterparties (and cash collateral) to amplify daily returns. They are generally designed for short-term, tactical use. The daily reset, higher fees, and path dependency change how returns behave over time.

The table below lists the key differences between traditional and leveraged ETFs:

Daily rebalancing and compounding

Leveraged ETFs aim to reset exposure at the end of each day to maintain their stated leverage (e.g., 2x). This daily reset introduces something called compounding – and its effect depends on the path of returns.

Steady uptrend: compounding may boost returns beyond a simple multiple.

Steady downtrend: compounding may reduce losses versus a simple multiple (because losses apply to a shrinking base).

Choppy or sideways market: compounding may erode returns. Traders often call this “volatility drag”.

Compounding example 1: Steady uptrend

Assume a stock gains 1% each day for ten straight days. A 2x leveraged ETF rebalances daily to keep exposure on target. Each day’s 1% gain applies to a larger base, so the compounded return may exceed a simple “1% × 10” add-up. The 2x ETF compounds on that growing base at roughly twice the daily rate. That means its 10-day result may end up above twice the stock’s 10-day return.

Compounding example 2: Steady downtrend

Now assume a stock loses 1% each day for ten straight days. A 2x leveraged ETF again resets daily. Each day’s 1% loss applies to a shrinking base, so the 10-day result ends up slightly better than a simple “1% × 10 × 2” calculation. Compounding on a smaller base cushions the losses compared with a straight double of the stock’s decline.

Compounding example 3: Alternating days (volatility drag)

Now assume the stock alternates between +1% and –1% each day for ten days. The stock ends nearly flat, because each gain is offset by the next loss. The 2x ETF still resets daily. But in this path, compounding works against it. The fund takes larger percentage moves on a changing base, and the alternating swings chew into the value. That’s volatility drag.

Key point: The daily reset is the feature that makes leveraged ETFs track today’s move. It’s also why multi-day outcomes can differ from a simple “2x over time”.

When might investors use leveraged ETFs?

Leveraged ETFs may suit the below uses:

Tactical trading: Express a short-term view on a stock or index.

Hedging: Use inverse or short leveraged products to hedge near-term risk (where available and appropriate).

Event-driven exposure: Earnings weeks, macro data releases, or set windows where you may want amplified daily exposure.

They’re less suitable for buy-and-hold investors. The daily reset, higher fees, and path dependency make long holding periods harder to manage. If you plan to hold Leveraged ETFs for longer, you must understand compounding risk and total costs.

Risks and benefits of leveraged ETFs

Potential benefits

Magnified daily returns: They may double or triple gains from short-term moves.

No margin account needed: You can buy and sell on an exchange like a regular ETF.

Tactical flexibility: They may help with quick trades, hedging, or speculation

Possible risks

Magnified losses: Even small market drops may lead to large losses.

Path risk: Choppy markets can erode value through volatility drag.

Counterparty exposure: Swap-based structures involve counterparties; funds mitigate this with collateral and limits, but the risk exists.

Sizing and discipline matter. Set exits, and treat leverage with respect.

FAQs

Do leveraged ETFs always hit the exact multiple each day?

They aim to, but actual results can differ due to fees, costs, and market factors. Under normal conditions, short-term tracking is usually close.

Can a leveraged ETF go to zero?

In extreme scenarios, severe adverse moves could result in very large losses. While trading halts and rebalancing aim to manage risk, your capital is at risk.

Are leveraged ETFs only for day trading?

They are generally designed for short-term use. Some investors may hold them for longer with strict risk controls, but compounding and costs can make that challenging.

Do all providers use the same derivatives?

No. Many rely on total return swaps. Some may use other derivatives in limited roles. The core objective is the same: target a daily multiple.

What fees do leveraged ETFs charge?

Leveraged ETFs charge an annual management fee, called the expense ratio. This fee may be higher than for traditional ETFs because of derivative, leverage, and rebalancing costs. The fee is taken from the fund’s net asset value (NAV) each day, which can reduce returns over time.

Leverage Shares offers a range of 2x daily leveraged single-stock ETFs covering popular US names like Nvidia, Tesla, Palantir, Coinbase, and more. These trade on US exchanges like stocks, offering easy access to short-term tactical exposure.

Key takeaways

Leveraged ETFs aim to amplify daily returns using derivatives such as swaps.

Daily rebalancing keeps leverage on target and introduces compounding effects.

Trends can help. Chop can hurt. The return path matters with leveraged ETFs.

Leveraged ETs may suit short-term, tactical traders. They’re typically less suitable for buy-and-hold investors.