When investing in a leveraged ETF, you’re aiming for amplified daily returns – like twice the return of a stock. But it’s important to know that these leveraged returns come with their own cost structure. In this guide, we’ll break down how leveraged ETF fees work and how they can impact your investment returns. We’ll also compare leveraged ETF fees to those of regular ETFs to show how they might differ.

How leveraged ETF fees work

As with “regular” exchange-traded funds, leveraged ETFs charge an annual fee called the expense ratio. It pays for running the fund and keeping leverage in place. Because leverage adds complexity, these fees can be higher than those charged by regular ETFs.

The fund takes this fee from its net asset value (NAV) each day. NAV shows what the fund is worth – everything it owns, minus costs, divided by shares. Each day, the fund shaves off a tiny slice of that annual fee. Across the year, those slices add up to the full expense ratio.

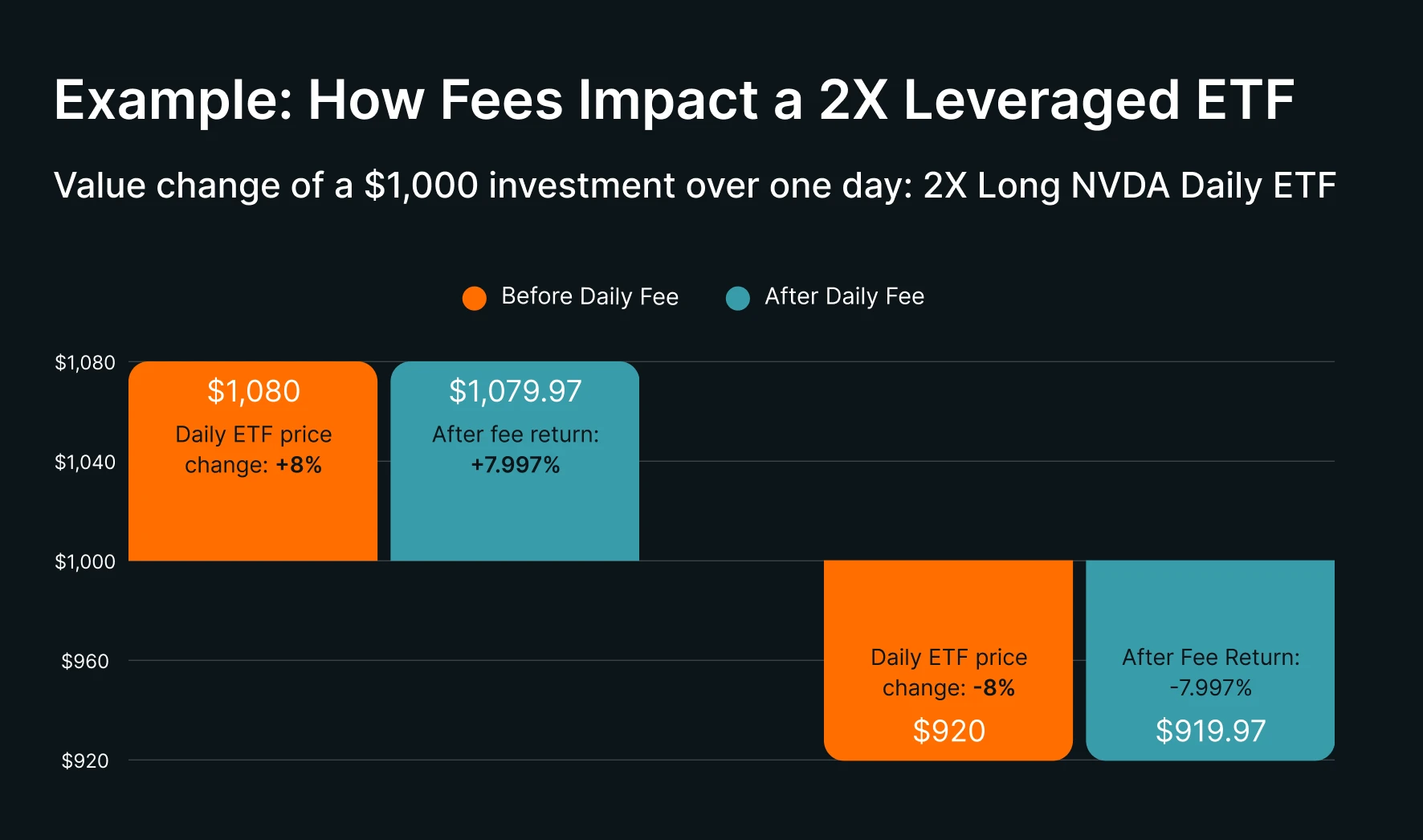

Hypothetical example: Fee impact on a 2x leveraged ETF

Say the 2X Long NVDA Daily ETF (ticker NVDG) gains 8% in a day when Nvidia’s stock rises 4%. The fund’s annual expense ratio is 0.75% – or about 0.0029% per day. After that small daily fee, the ETF’s return comes to roughly 7.997%. It’s barely noticeable day to day, but fees can add up over time.

Now suppose you invest $1,000 in the same ETF. An 8% move before fees would take your position to about $1,080. After the fund deducts its daily fee, your value would be more like $1,079.97.

If Nvidia falls 4% in a day, the ETF aims for about an 8% drop. Your position would fall to roughly $920 before fees, and around $919.97 after the same daily deduction.

Note: All figures are illustrative. Actual results depend on each fund’s expense ratio, daily compounding, and market path.

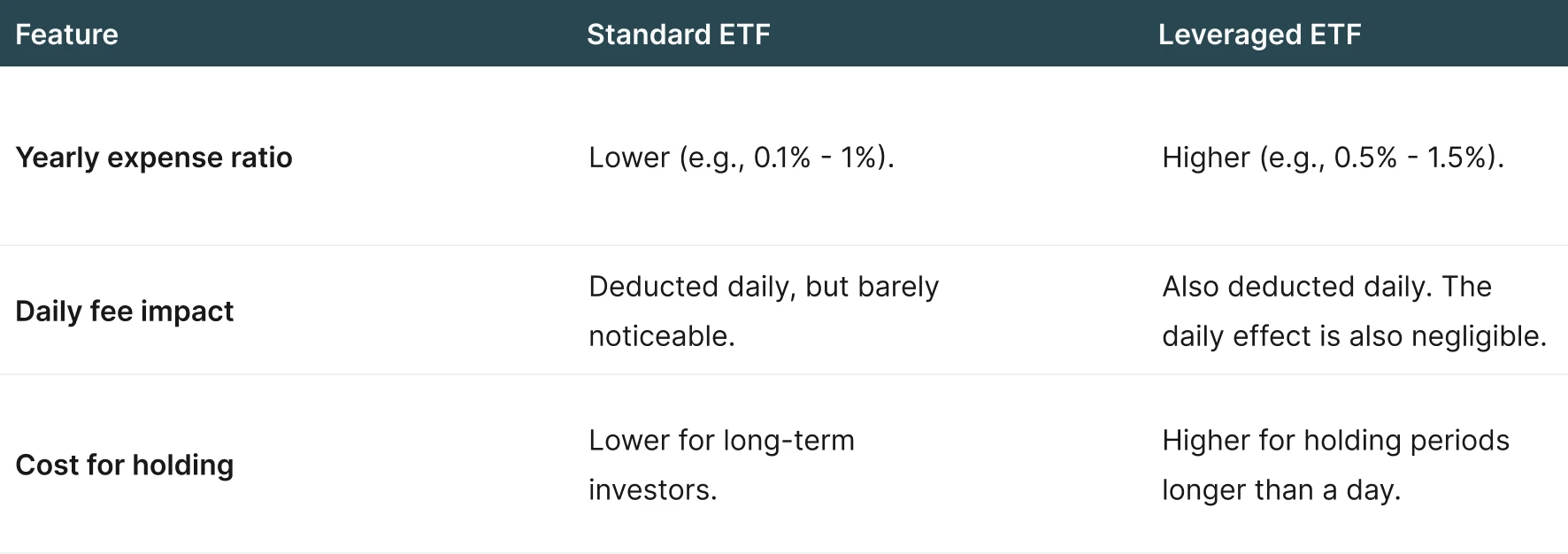

Leveraged ETF fees vs regular ETF fees

Leveraged ETFs tend to have higher expense ratios than regular ETFs. That’s because they use derivatives to “synthetically” boost daily returns without holding the underlying assets.

The table below shows how fees for leveraged ETFs typically compare to standard ETFs:

Keep in mind that most investors only hold leveraged ETFs for a short time – usually a day or less. So, daily fees tend not to add up as much for those investors. That’s because leveraged ETFs “reset” each day to maintain the same leverage ratios, which can lead to adverse “compounding” effects over time. Learn more about leveraged ETFs and compounding here.

Leveraged ETFs also have other trading costs, which can stack up the more you trade. You’ll pay your broker’s dealing fee when you buy or sell, and there’s usually a small gap between the bid and ask price – called the spread. For short-term traders, these costs usually matter more than the fund’s expense ratio.

Leverage Shares offers 2X daily leveraged ETFs on popular US stocks such as Nvidia, Tesla, and Palantir. Each fund currently charges a 0.75% annual expense ratio – below the industry average for leveraged ETFs.

Key takeaways

Leveraged ETFs tend to charge higher expense ratios than regular ETFs. This is mostly due to the costs of maintaining leverage ratios.

Each day, the fund subtracts a small fee from its NAV. That means your leveraged return will be slightly below the target multiple after expenses.

If you trade leveraged ETFs, remember that these daily fees can add up over longer holding periods.

Leveraged ETFs also have other trading costs, such as broker fees and spreads. These can matter more to short-term traders.