UnitedHealth issued its 2025 earnings forecast significantly below market expectations

The company is contending with sharply rising medical costs in its Medicare Advantage business

Despite setbacks UnitedHealth maintains its dividend policy

UnitedHealth Group’s Q2 2025 Earnings Shock Investors

UnitedHealth Group reported second-quarter 2025 results with earnings falling significantly below Bloomberg expectations1, sending its shares down more than 16% in the days following the announcement.

Earnings per share, adjusted: $4.08 adjusted vs. $4.59 expected

Revenue: $111.62 billion vs. $111.58 billion expected

Net Income, adjusted: $3.72 billion vs. $4.13 billion expected

The company delivered revenue of approximately $111.6 billion, an increase of almost 13% from the prior year, but earnings fell well short of expectations. Adjusted earnings per share dropped about 40% from the same period last year, reflecting a significant deterioration in profitability despite healthy top-line growth.2

Medical Costs Surge and Margins Contract

The main driver of the earnings shortfall was a surge in medical costs. The medical care ratio, which measures the proportion of premiums spent on patient care, rose to 89.4%, more than four percentage points higher than a year ago. This increase was fuelled by elevated utilization of outpatient, physician, and inpatient services, particularly within the Medicare Advantage business. Operating costs climbed at a faster pace than revenue, compressing margins and reducing net profitability.2

Key Segment Trends

UnitedHealth Group offers healthcare coverage along with data analytics and software solutions, operating through its four main segments: UnitedHealthcare, Optum Rx, Optum Insight, Optum Health, each with well-established operations.

UnitedHealthcare: Revenue surged 17% year-over-year to $86.1 billion, from $73.9 billion. Q2 2025 earnings from operations declined from $4.0 billion in 2024 to $2.1 billion in 2025. Operating margin declined to 2.4% from 5.4% in 2024. This was primarily due to higher-than-expected medical cost trend across the UnitedHealthcare businesses and the effects of the Medicare funding reductions.2

Optum Health: Q2 2025 revenue fell 7% year-over-year to $25.2 billion, mainly reflecting previously disclosed legacy contract adjustments and the impact of Medicare Advantage funding reductions. Operating income dropped sharply to $636 million from $1.9 billion a year earlier, with margins narrowing to 2.5% from 7.1%. The decline was mainly driven by increased medical care utilization, underpriced health plan offerings, the Medicare funding cuts, underestimated effects from the V-28 risk model transition, and a change in the patient mix.2

Optum Insight: Revenue rose 6% year-over-year to $4.8 billion, supported by a broad range of technology- and data-driven solutions. Operating income nearly doubled to $998 million from $546 million, with margins improving to 20.7% from 12.0%. Growth was fuelled by easing impacts from the Change Healthcare cyberattack, a favourable service and product mix, and greater operating efficiency.2

Optum Rx: Revenue climbed 19% year-over-year to $38.5 billion, benefiting from new client wins and deeper penetration within existing accounts. Operating income was flat at $1.4 billion, with margins slipping to 3.7% from 4.3%. Operating margin declined year-over-year, largely driven by the higher revenue in Q2 2025 being offset by greater dispensing of high-cost medications and expenses related to the initial rollout of the private-label business. Adjusted prescriptions rose to 414 million, up from 399 million in the prior year.2

Full-Year 2025 Outlook Cut Sharply

In response to these pressures, UnitedHealth cut its full-year 2025 earnings guidance to at least $16 per share, down sharply from its previous target and well below last year’s performance. The company also lowered its forecast for operating cash flow to around $16 billion from more than $24 billion in 2024. Revenue for the year is now expected to come in between $445.5 billion and $448 billion, slightly under earlier projections. The company expects to return to earnings growth in 2026.2

Regulatory and Legal Risks Add to Headwinds

The challenges facing UnitedHealth are not limited to cost inflation. Regulatory scrutiny is intensifying, with ongoing Department of Justice investigations into Medicare billing practices that could result in financial penalties.3 Lawmakers are also increasing pressure on pharmacy benefit managers such as Optum Rx to improve transparency in drug pricing. The company’s removal from major growth stock indices could also weigh on how the market perceives its growth prospects.

New CEO Stephen Hemsley emphasized that the company is strengthening oversight, deploying AI-driven auditing tools, and engaging independent experts such as Analysis Group and FTI Consulting, to review risk management, pharmaceutical services, and care delivery processes.4

The first findings from these independent reviews are expected in Q4 2025. Hemsley admitted that beyond industry-wide challenges, UnitedHealth has made pricing and operational missteps that are being addressed with immediate remediation where necessary.

Dividend Commitment Despite Earnings Pressure

Despite the earnings setback, UnitedHealth maintained its commitment to shareholder returns, distributing about $4.5 billion through dividends and buybacks in the second quarter. The company also raised its quarterly dividend in June, signalling confidence in its long-term cash flow generation even as near-term profitability remains under pressure.2

UnitedHealth’s board of directors authorized the payment of a quarterly dividend of $2.21 per share, which will be distributed on September 23, 2025 to investors on record as of September 15, 2025. This represents a dividend yield of above 3%, which is higher than other healthcare companies.

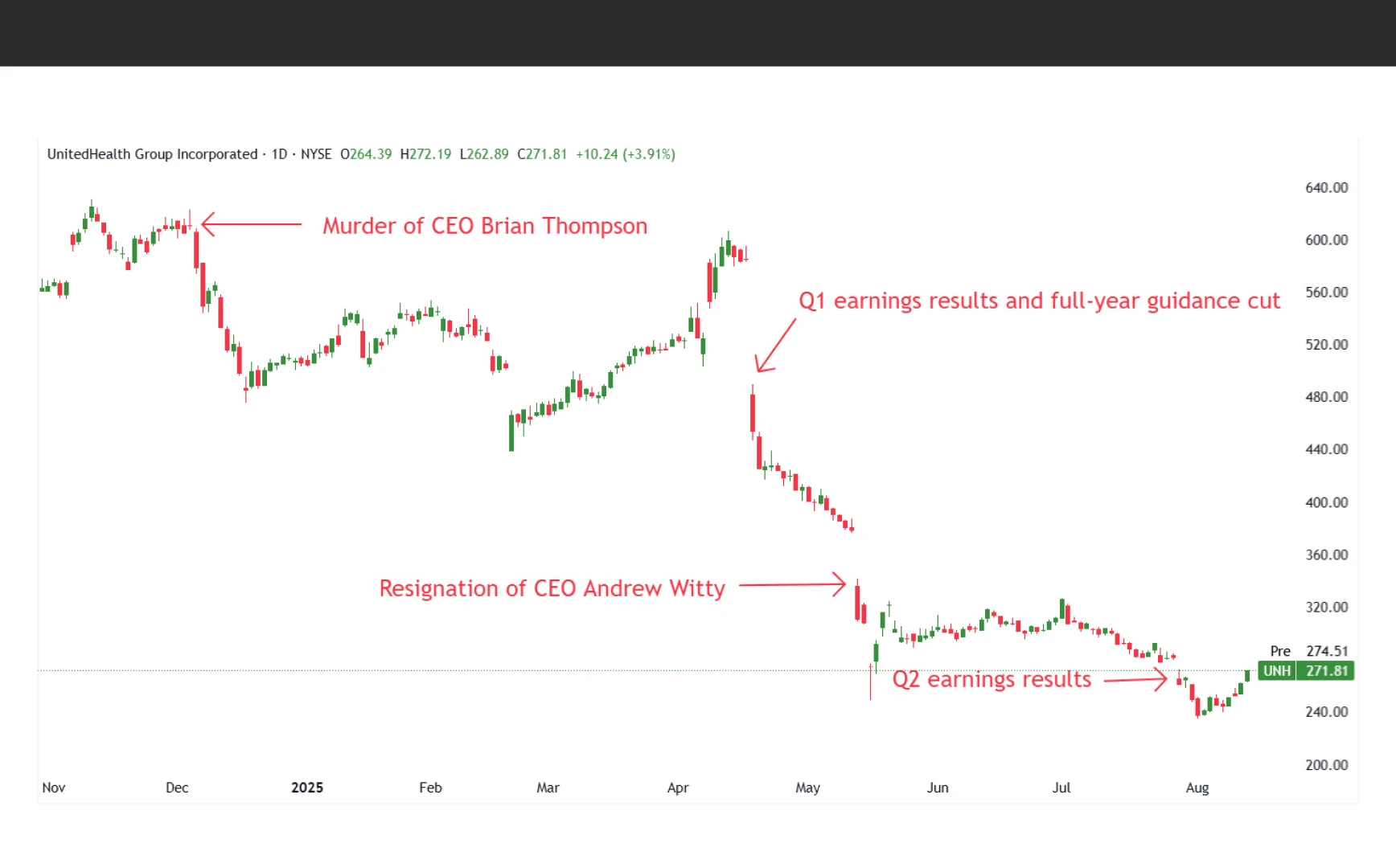

Source: TradingView, UnitedHealth Price Chart as of August 14, 2025

The Industry’s Bellwether Crisis Creates Opportunity

UnitedHealth Group, once considered a cornerstone of the healthcare insurance sector, has seen its stock change abruptly from steady performer to sharp decliner. The company has endured a tumultuous period since December 2024, marked by a series of crises that have severely eroded investor confidence. The company’s troubles began with the tragic murder of UnitedHealthcare CEO Brian Thompson on December 4, 2024, followed by public backlash over its practices and a historic cyberattack that impacted millions of Americans.5

Entering 2025, the challenges deepened. On April 17, the stock plunged following disappointing Q1earnings results and a cut in full-year guidance. Then in May 2025, UnitedHealth withdrew its full-year outlook amid rising medical utilization and replaced CEO Andrew Witty with Stephen Hemsley, the company’s chairman and former chief executive from 2006 to 2017.5

The mounting regulatory scrutiny, suspended earnings guidance, several leadership changes, questions over operational execution, and persistently high medical costs, triggered UnitedHealth shares to fall 62%, from over $622 on December 4, 2024, to $234 by August 1, 2025.

While Hemsley’s return may provide an opportunity to reassert control ahead of 2026’s results, unless medical cost trends stabilize and the benefits of management’s corrective actions become clear, investor sentiment could remain fragile. For now, the next few quarters will be critical in determining whether UnitedHealth can restore profitability and rebuild market confidence.

Despite the current crisis, even without taking into account potential Medicare Advantage rate increases in 2026, which will offer a relief and could provide a foundation for recovery, we see the current share price weakness as excessive, suggesting a potential for a rebound.

From a technical analysis perspective, given the strongly oversold momentum conditions triggered by the sharp share price decline in 2025, the stock is likely to re-test its latest gap resistance and may eventually fill the gap formed on May 13, 2025. This points to a potential upward move toward $342, with further upside possible to around $376. Over the long-term, a return to earnings growth could propel prices higher.

Footnotes:

1 Bloomberg Terminal, UnitedHealth Earnings Estimates, as of August 14, 2025

2 UnitedHealth Group Press Release, UnitedHealth Group Re-Establishes Full Year Outlook and Reports Second Quarter 2025 Results, as of Julu 29, 2025

3 Medical Economics, UnitedHealth Group under DOJ investigation over Medicare billing practices, as of July 24, 2025

4 UnitedHealth Group, Earnings Conference Call, as of July 29, 2025

5 Morningstar, UnitedHealth Pulls 2025 Outlook and Replaces CEO, as of May 13, 2025