Coinbase misses on both revenue and earnings

Subscription and services revenue increased by 9%

Institutional trading volume decreased by 9%, while consumer trading volume fell by 17%

Q1 Financial Highlights:

Earnings per share (EPS): $0.24 vs. $4.40 a year ago

Revenue: $2.0 billion, down 10% from the prior quarter

Net income: $66 million vs. $1.2 billion a year ago

Coinbase Q1 2025 Revenue and Earnings Miss Expectations

Coinbase Global Inc. released its financial results for the first quarter of 2025, reporting a substantial miss on both earnings and revenue. The company posted earnings per share (EPS) of $0.24, significantly below $4.04 in the same corresponding period in the previous year.1

However, total revenue for the quarter came in at $2.03 billion from $1.64 billion in the prior year, but missed Wall Street estimates of $2.1 billion. This underperformance is in stark contrast from previous quarters where the company met or exceeded expectations.5

Despite the miss, revenue still showed a 24% year-over-year increase, driven by higher transaction, subscription, and services income. The company’s performance underscores its ability to grow revenue in a challenging market, although signs of softness in institutional trading and fee compression remains a concern.2

Net income of $65.6 million, or $0.24 per share is down from $1.18 billion, or $4.40 a share from a year earlier. Excluding the impact of crypto investments, Coinbase’s adjusted earnings were $527 million, or $1.94 per share.1

Transaction Volumes Rise, But Trading Revenue Faces Pressure

Total trading volume increased 26% year over year to $393 billion. This growth was attributed to a more active trading environment early in the quarter, particularly among retail investors. Nevertheless, trading volumes fell 10.5% from Q4 2024, reflecting a decline in cryptocurrency prices that began in mid-January until early April.2

Transaction revenue came in at $1.3 billion, up 18.2% year over year but down 19% from the prior quarter.1 The drop was largely due to reduced institutional trading, lower fee rates, and the impact of incentives and rebates. Institutional trading volume fell 9% to $315 billion from the prior quarter.2 Despite these pressures, Coinbase continues to maintain strong retail trading activity, which remains a key revenue driver.

Subscription and Services Revenue Surges on Stablecoin Growth

Coinbase’s Subscription and Services revenue reached a record high of $698 million, marking a 9% increase from the previous quarter2, even as the total cryptocurrency market capitalization fell by nearly 20% over the same period.

This growth was primarily driven by a surge in stablecoin-related income. The company’s partnership with Circle, the issuer of USD Coin (USDC), continues to pay off, as USDC balances on Coinbase surged 39% Q/Q to $41.9 billion.2

Beyond stablecoins, Coinbase is growing its infrastructure-based revenue streams, including staking, custodial services, and its “Coinbase as a service” model. These offerings are becoming increasingly important as they provide a hedge against the volatility of trading revenue. Institutional interest in white-labelled crypto infrastructure is rising, which could support more consistent revenues in the future.

Profitability Holds Steady Despite Rising Expenses

Adjusted EBITDA for Q1 2025 stood at $930 million, down 8.3% year over year. While the company remains profitable, the slight decline in EBITDA reflects rising operating costs. Total expenses rose 51.5% year over year to $1.3 billion, driven by increased sales and marketing efforts, as well as higher general and administrative costs associated with headcount expansion and payroll taxes.1

Coinbase has signalled that elevated expenses will likely continue into Q2 2025. The company expects technology, development, and administrative costs to be between $700 million and $750 million, alongside projected marketing expenses of up to $375 million.2 These increases reflect Coinbase’s ambitions to maintain user engagement and expand its global footprint.

Strategic Acquisition of Deribit Boosts Derivatives Ambitions

In a major strategic move, Coinbase announced its $2.9 billion acquisition of Deribit, a leading global crypto derivatives exchange. This deal is the largest acquisition seen in the cryptocurrency industry. The deal is set to significantly strengthen Coinbase’s position in the crypto derivatives space, an area in which it has only recently established a presence. Deribit boasts $1 trillion in annual trading volume and $30 billion in open interest, making it the market leader in crypto options.2 Coinbase executives emphasized during the earnings call with analysts that the acquisition is highly complementary to the company’s institutional offerings and could open new growth avenues outside the U.S. The deal is a smart long-term bet on derivatives, and the transaction is expected to close by year-end.3

Regulatory Environment

Coinbase continues to go through a complex U.S. regulatory environment, though recent developments suggest increasing momentum toward clearer frameworks. In its Q1 earnings release, the company cited the creation of a Strategic Bitcoin Reserve and movement on digital asset legislation as signs of progress.3

The company also sees potential support from the White House. With President Donald Trump publicly backing crypto innovation, Coinbase executives expressed optimism that the administration could play a favourable role in regard to regulation. Additionally, the dismissal of the SEC lawsuit against Coinbase is a major judicial win.4

Anticipated regulatory clarity in the U.S., particularly around stablecoins and market structure legislation expected later this year could serve as a major catalyst for Coinbase, likely encouraging traditional financial institutions to adopt its offerings instead of building their own in-house crypto solutions.

While short-term volatility is expected due to unresolved trade tensions and macroeconomic uncertainty, the broader conditions are aligning to support a potential extended bull market in cryptocurrencies over the next 12 months, which is likely to support the share price of Coinbase.

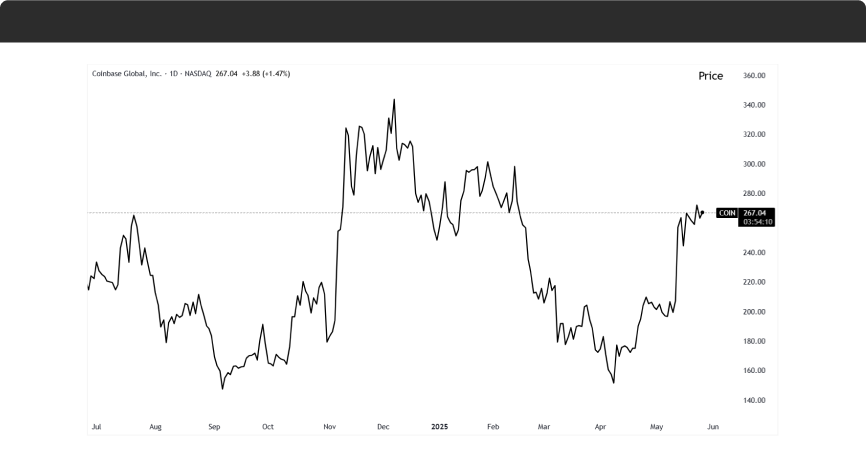

Source: TradingView, Coinbase Daily Chart, as of May 27, 2025

Coinbase Will Join the S&P 500 Index

Shares of Coinbase surged on Tuesday following its historic inclusion in the S&P 500 index, the first digital asset company to join the benchmark. This milestone is significant for the crypto industry, long viewed as peripheral to traditional finance, and now increasingly recognized as a key driver of financial innovation.

The inclusion highlights a broader turnaround in sentiment toward crypto, fuelled by growing institutional interest and a more favourable regulatory outlook, particularly in light of recent promises from President Donald Trump to adopt a lighter regulatory approach.

We believe the inclusion in the S&P 500 would be beneficial for Coinbase as institutional investors gradually adjust their portfolios to include the stock. Additionally, demand is expected to rise as passive funds tracking the index incorporate Coinbase into their holdings. With its expanding institutional client base and strategic push into international markets, Coinbase is solidifying its position as the world’s leading publicly traded cryptocurrency exchange.

From a technical analysis point of view, Tuesday’s price action decisively broke above its resistance, confirming an inverse head and shoulders. The pattern has bullish implications and suggests that prices in the range between $280 and $290 could unfold over the medium-term.

Footnotes:

1Coinbase Quarterly Report, as of March 31, 2025

2Q1 2025 Shareholder Letter, as of May 8, 2025

3Coinbase Earnings Call Transcript, as of May 8, 2025

4U.S. Securities and Exchange Commission, SEC Announces Dismissal of Civil Enforcement Action Against Coinbase, as of February 27, 2025

5Bloomberg Terminal, as of May 15, 2025