Advanced Micro Devices (AMD) stock has had a strong run in 2025. Up around 90%1 year to date, it has outperformed Nvidia, Broadcom, and many other artificial intelligence (AI) stocks. Looking ahead, forecasts suggest that the stock is far from tapped out as AMD is expected to generate blockbuster growth amid the global data center boom. Here are some recent growth projections from the chip company and a look at Wall Street’s share price forecasts for 2026.

AMD’s 2025 Financial Analyst Day Was a Game-Changer

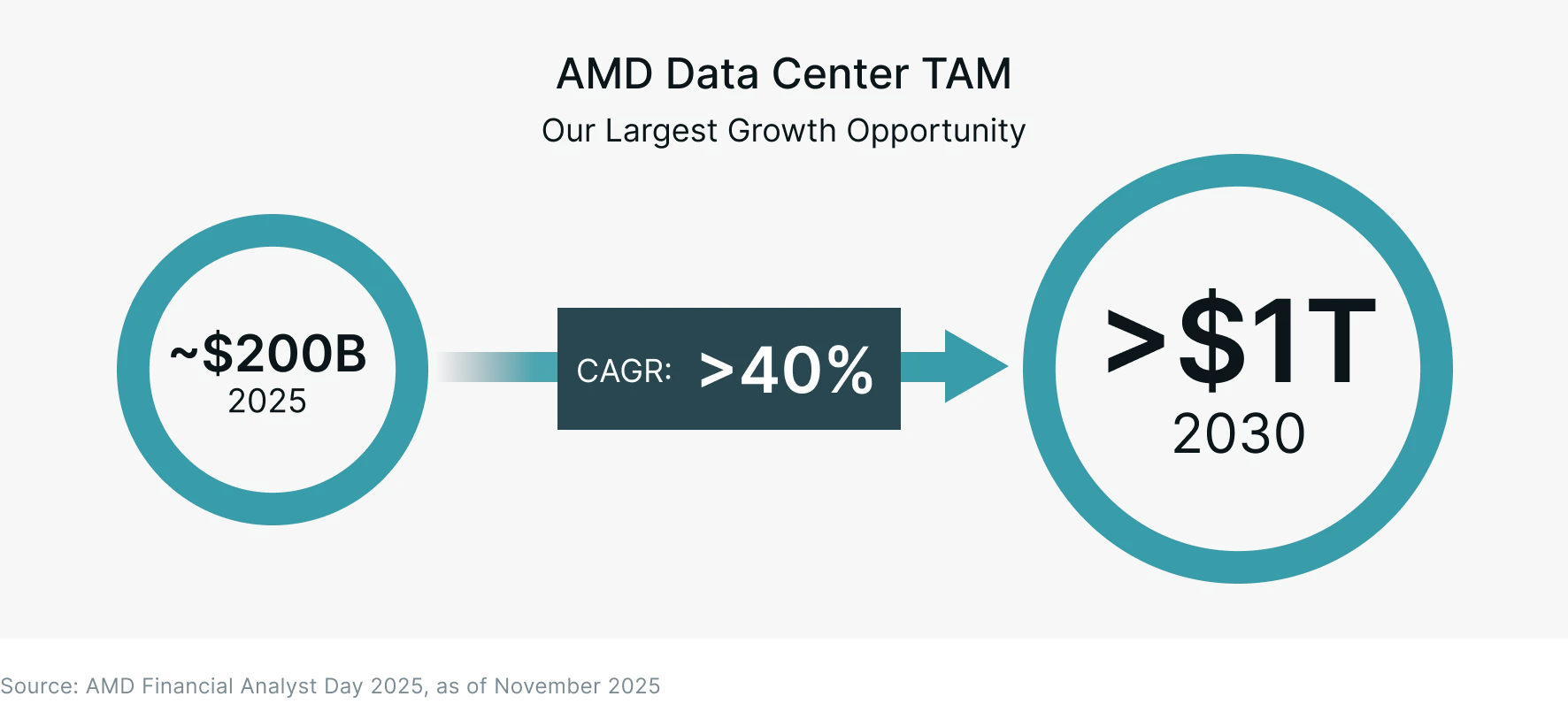

On November 11, 2025, AMD held its annual Financial Analyst Day2. This was a pivotal event in which the company outlined its plans to capture significant market share in the rapidly growing AI and data center markets. At the event, AMD dramatically increased its forecast for the total addressable market (TAM) for its data center business. It now believes that the TAM will exceed $1 trillion by 2030, up from a previous projection of $500 billion by 2028.

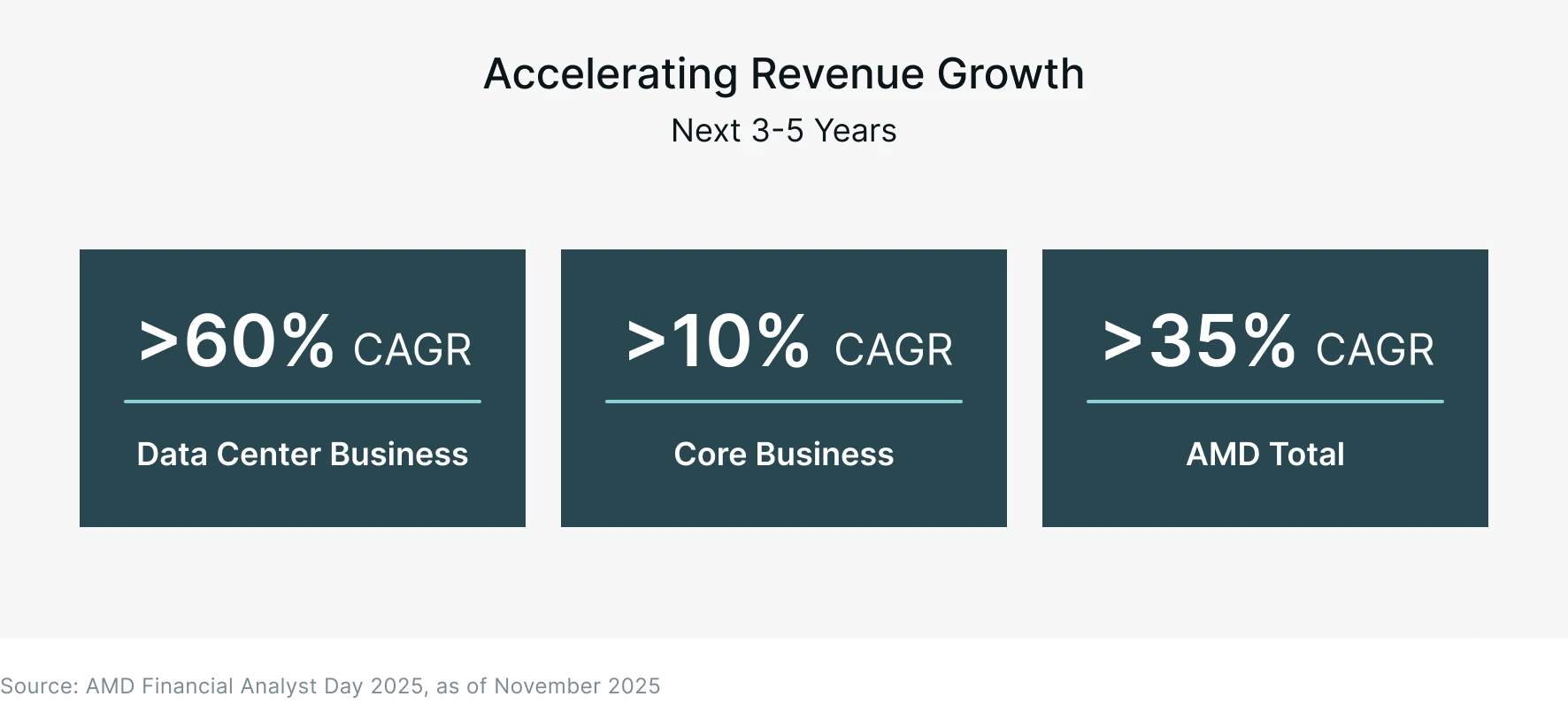

Higher Revenue Growth Projections

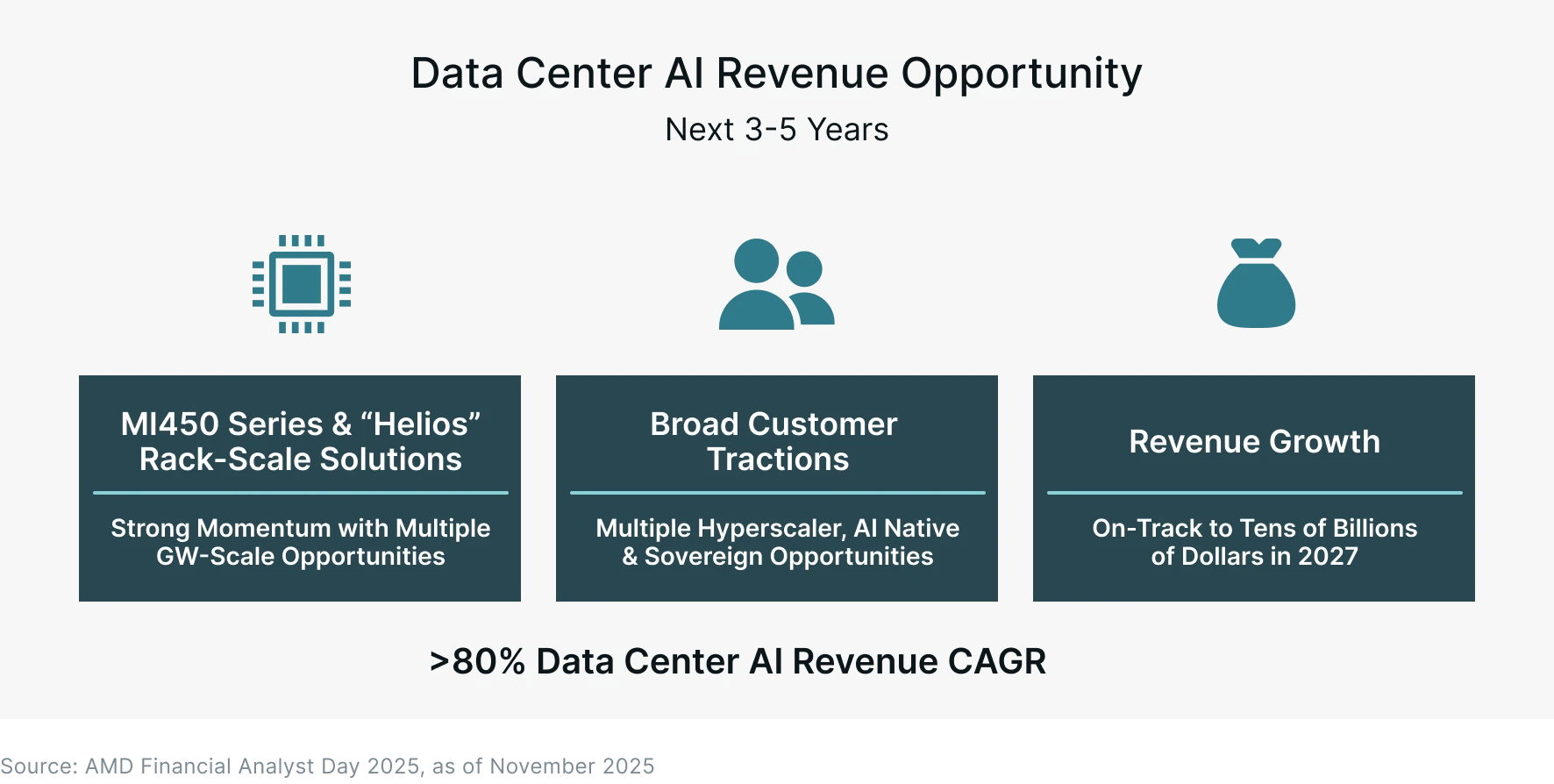

AMD is hoping to capture a "double-digit share" of this massive new market. It sees opportunities from hyperscalers, sovereigns, and AI natives and with its powerful Instinct GPUs, it’s confident in its growth prospects. Given the immense growth opportunities, the company is now targeting a revenue compound annual growth rate (CAGR) in excess of 35% over the next three to five years. Breaking this down, it’s targeting 60% revenue CAGR for its data center business and 80% revenue CAGR for data center AI.

End-to-End AI Solutions

Zooming in on AMD’s AI strategy, a key component is going to be its "Helios" rack-scale systems. These are full server racks - designed specifically for AI training and inference workloads - that when fully loaded can contain up to 72 Instinct MI450 GPUs. An advantage of these systems is that they are open in design meaning that hyperscalers and other AI enterprises can easily adopt, customize, and integrate them, bypassing the need to develop rack systems themselves. These systems are expected to be launched and deployed in the third quarter of 2026.

AMD also highlighted its software at the Financial Analyst Day. Here, it emphasized the growing momentum of its open-source software platform, ROCm, noting a 10-fold year-over-year increase in downloads. When combined with the company's Instinct GPUs and Helios rack-scale systems, AMD has a complete, end-to-end solution for the AI supercomputer era. Instead of just selling chips, it’s now able to offer full-stack solutions that can be quickly and efficiently deployed in data centers globally.

Wall Street’s 2026 Forecasts for AMD Stock

Overall, the message from AMD at its Financial Analyst Day was that it plans to be a dominant force in the high-growth, trillion-dollar AI compute market. And this got the attention of Wall Street analysts. Since the event, many firms have increased their price targets3 for the chip stock with a significant number of firms going to $300 and several going to $350. The highest price target, $380, is from Melius Research, which believes that AMD can capture 10% of the AI market in the years ahead. As for the average price target, it’s currently $277. That implies upside of around 20% from here.

Footnotes:

1Google Finance, as of November 19, 2025

2AMD Financial Analyst Day 2025, as of November 2025

3Investing.com, Advanced Micro Devices (AMD), as of November 19, 2025