On October 6, AI chip designer Advanced Micro Devices (AMD) announced a major partnership1 with ChatGPT owner OpenAI. This partnership will see AMD’s Instinct GPUs power OpenAI’s next-generation infrastructure in the years ahead as the AI powerhouse expands.

On the back of this development, AMD’s share price shot up spectacularly, closing 24% higher at $203 on the day of the news. Wall Street seems to believe that the chip stock can go higher however - since the deal was announced many firms have increased their AMD price targets significantly.

Unpacking the AMD/OpenAI Deal

Under this new agreement, OpenAI will work with AMD as a core strategic compute partner, deploying six gigawatts of AMD GPUs over time. The partnership will start with the Instinct MI450 series of GPUs - with the first one gigawatt deployment of GPUs set to begin in the second half of 2026 - and extend to future generations of AMD GPUs.

As part of the agreement, AMD has issued OpenAI a warrant for up to 160 million AMD shares, structured to vest as specific milestones are achieved. The first tranche of shares vests with the initial one-gigawatt deployment, with additional tranches vesting as purchases scale up to six gigawatts.

For AMD, this deal is likely to deliver “tens of billions” of dollars in revenue for the company and be “highly accretive” to non-GAAP earnings per share, according to CFO Jean Hu. And because of the ripple effect of the agreement, the company could receive more than $100 billion2 in new revenue over four years, according to management.

As for OpenAI, the partnership could help to accelerate its infrastructure buildout and enable the company - which is now worth over $500 billion - to bring the benefits of advanced AI to everyone faster. So, it appears to be a potentially win-win deal.

New AMD Stock Price Targets

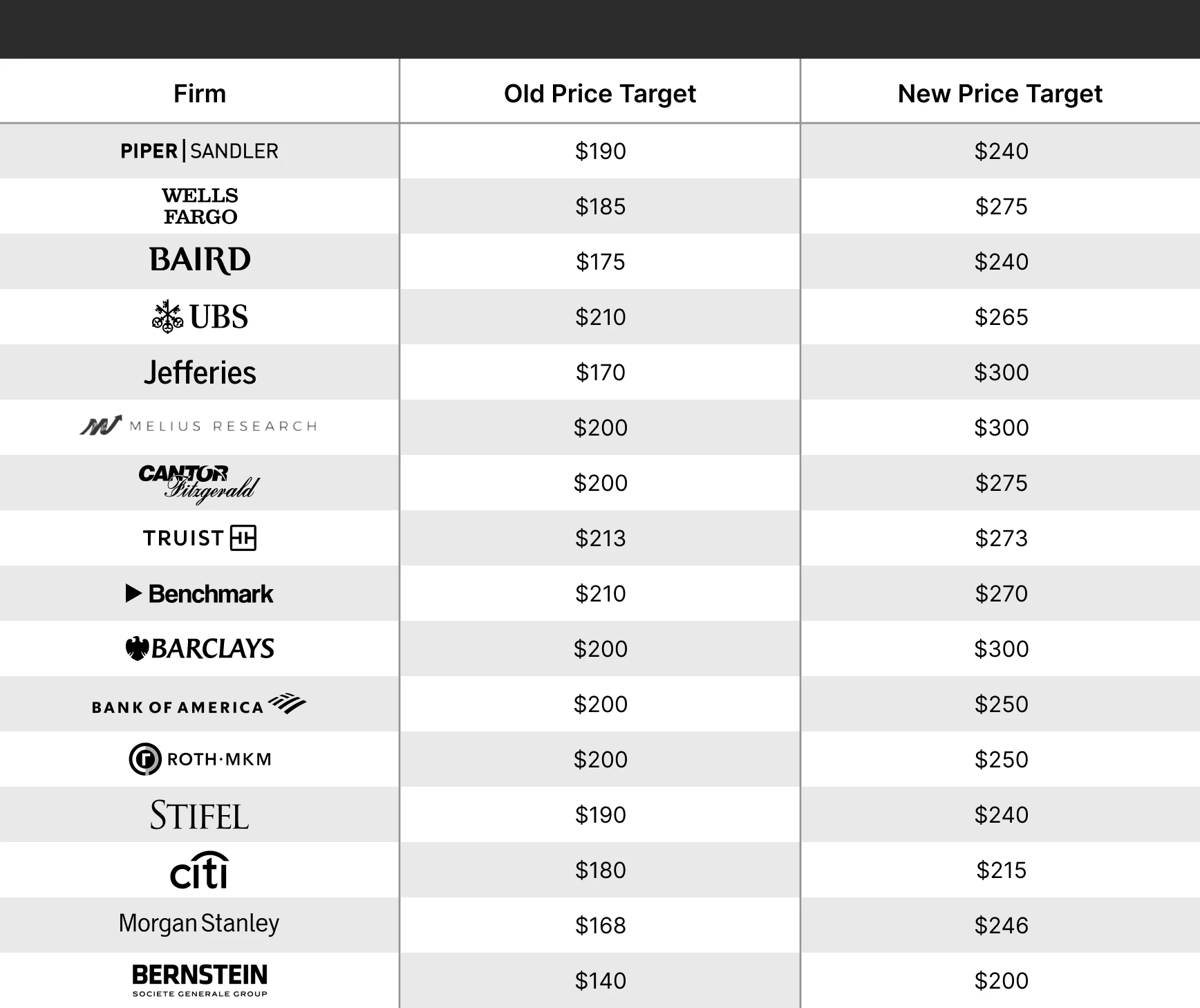

Since the deal was announced, many Wall Street analysts have increased their price targets3 for AMD, stating that the partnership represents a major vote of confidence in AMD's AI chips and software. New AMD share price targets are shown in the table below.

What’s notable about some of these target prices is the scale of the increases. For example, several firms have gone from $200 or below to $300.

Given this bullish analyst sentiment, AMD could be a stock to watch in the months ahead.

Footnotes:

1OpenAI, AMD and OpenAI announce strategic partnership to deploy 6 gigawatts of AMD GPUs, as of October 6, 2025

2Reuters, AMD signs AI chip-supply deal with OpenAI, shares surge over 34%, as of October 6, 2025

3Investing.com, Advanced Micro Devices (AMD), as of October 7, 2025