U.S.-based brokerage Robinhood (HOOD) has evolved from a disruptor in the retail brokerage industry to a significant player in the stock trading and investment app ecosystem. With a mission to democratize finance for all, it has built a brand and user base around simplicity and accessibility, enabling anyone – regardless of income or experience – to invest in stocks, options, ETFs, and even cryptocurrencies.

The company’s stock has been rising in investor conviction on the back of some strong trends evident in its monthly metrics.

What’s Fuelling Robinhood’s Rise?

Retail trading has exploded in popularity in the past decade, and Robinhood has presented itself as a leader in democratizing access to the stock market. Its easy-to-use interface, zero-commission trading, and no-minimum investment policies cater to a broad and growing demographic. The younger generation, including Millennials and Gen Z, has become increasingly interested in DIY investing.

A key driver of Robinhood’s business model is “Payment for Order Flow” (PFOF), where the platform routes customer orders to market makers such as Citadel Securities and Virtu Financial in exchange for compensation. These market makers profit by capturing the spread or executing other trading strategies. While PFOF has allowed Robinhood to offer free trades, it remains controversial, raising questions around trade execution quality and potential conflicts of interest. Regulators including the SEC and FINRA have weighed in, with ongoing discussions around potential reforms to the practice.

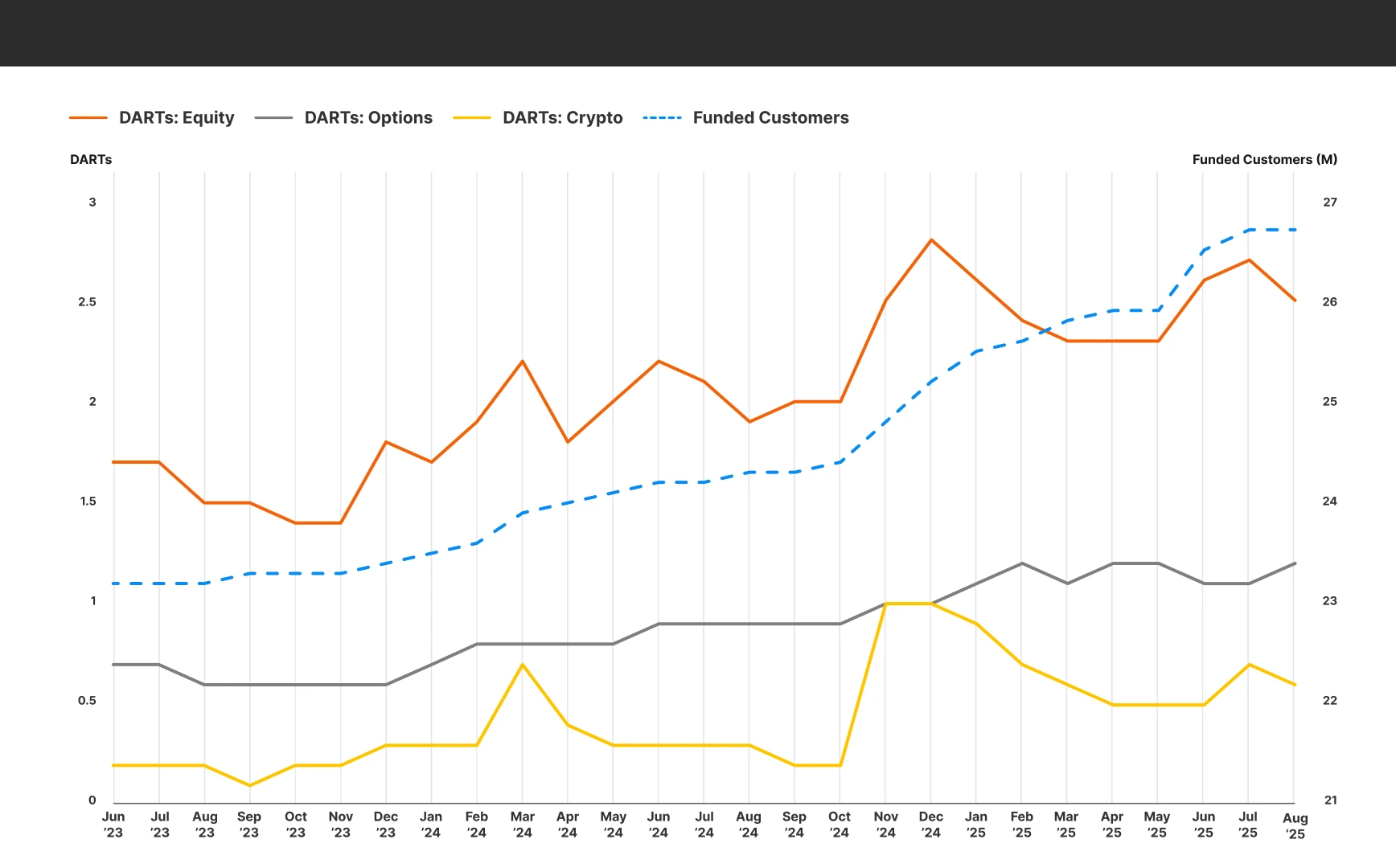

Despite the scrutiny, PFOF has enabled Robinhood to maintain a zero-commission structure that continues to drive user engagement. One metric that reflects this growth is DARTs (“Daily Average Revenue Trades”) – representing the average number of revenue-generating trades executed by a brokerage’s customers – has risen sharply alongside the platform’s expanding user base.

Source: Company Information; Themes ETFs analysis

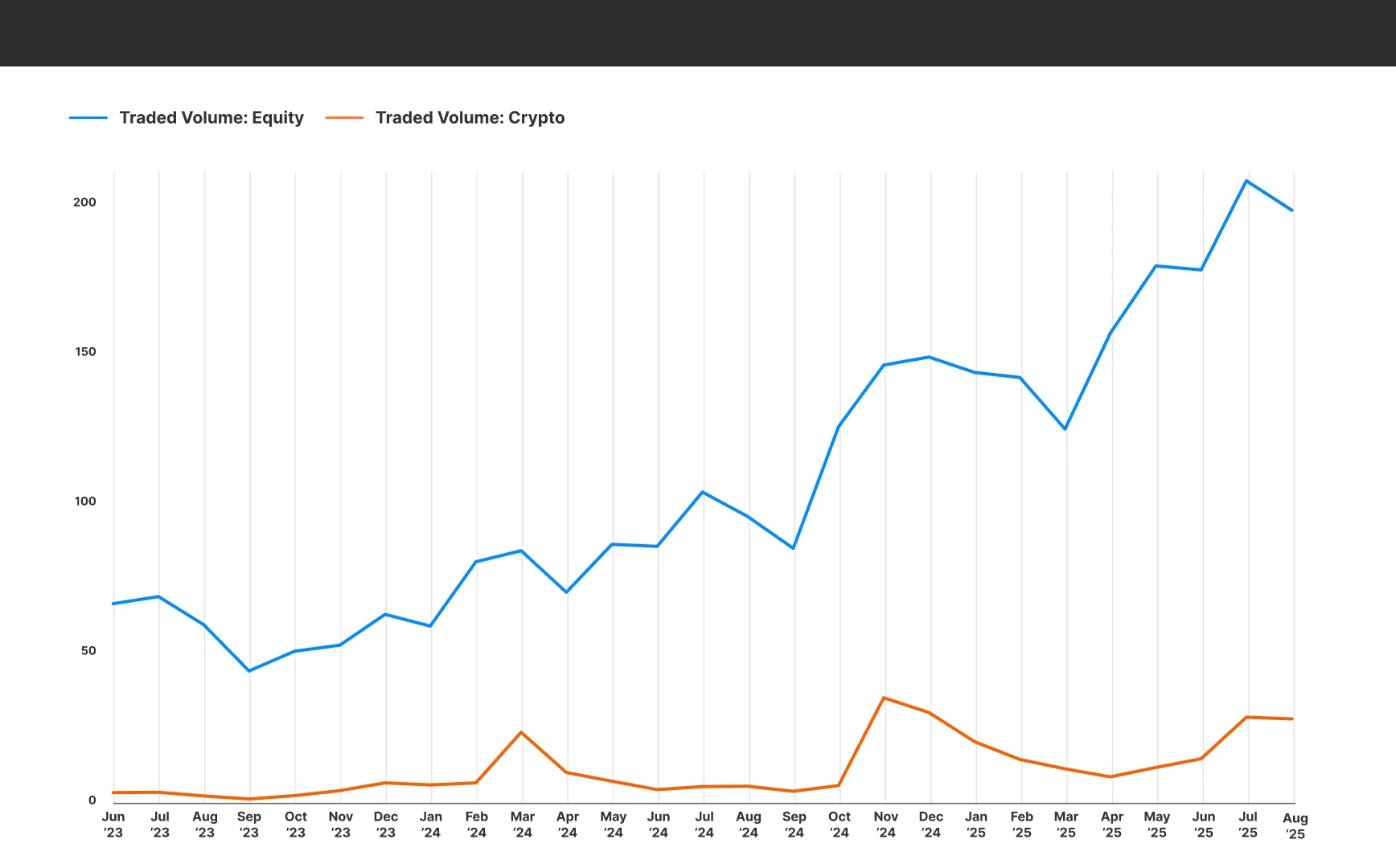

Between June 2023 and August 2025, Robinhood’s user count grew from 23.3 million to 26.7 million1,2. During this period, equity trading volumes – particularly favoured by beginner and intermediate investors – surged by 198%.

Source: Company Information; Themes ETFs analysis

While crypto trading hasn’t seen a similar surge over the same period, it remains a strategic pillar for Robinhood. The platform continues to support a wide array of crypto assets, reinforcing its appeal to younger, risk-tolerant investors.

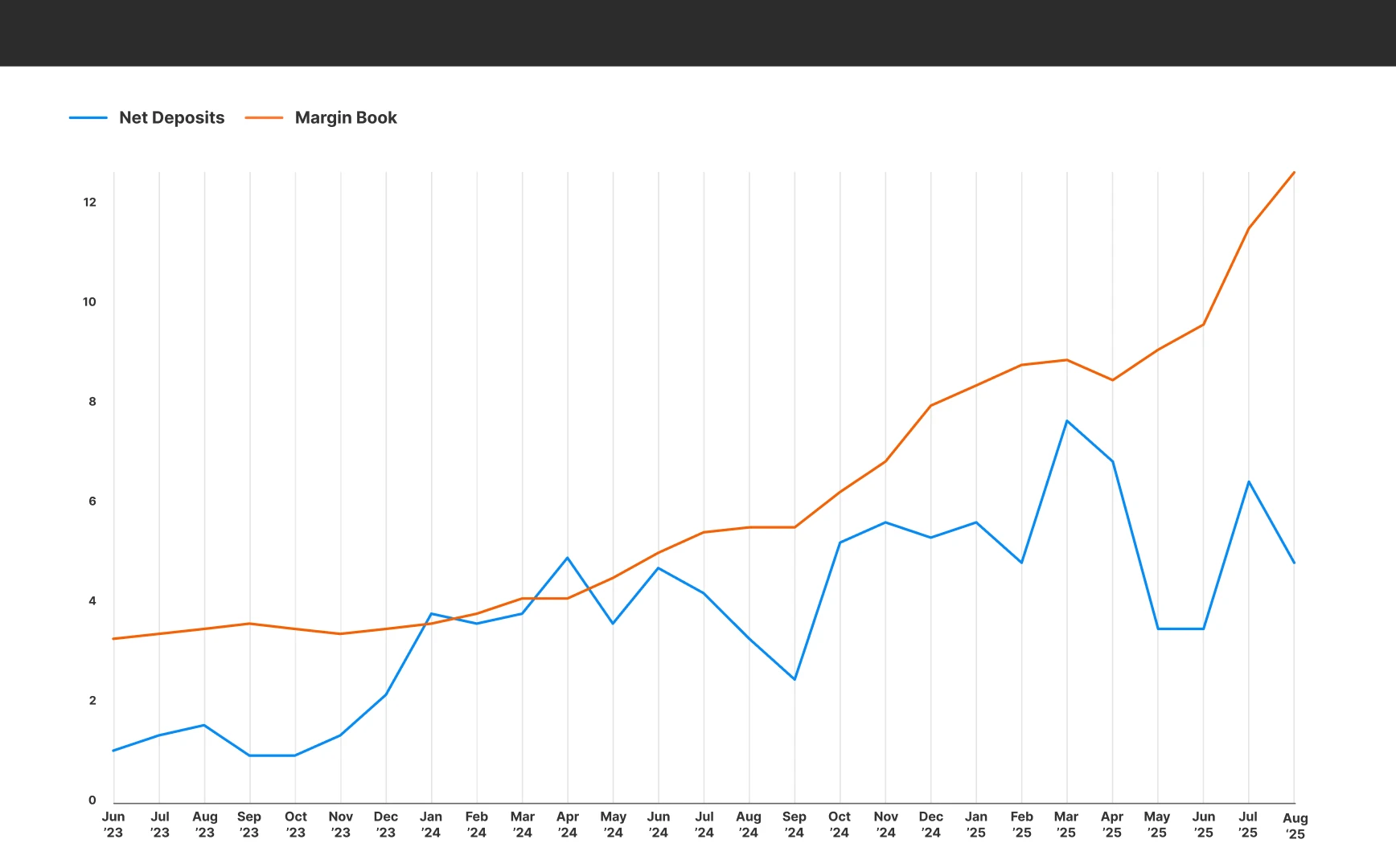

One standout trend is the 279% increase in Robinhood’s margin book, indicating strong growth in loans extended to customers for investing.

Source: Company Information; Themes ETFs analysis

This margin lending, coupled with interest earned on uninvested customer cash, offers Robinhood a secondary revenue stream, especially in periods of volatile or fluctuating deposits.

Triggers to Look Forward To

While Robinhood’s current footprint remains U.S.-centric, its international expansion – especially into Europe and the UK – could be a significant growth catalyst. If the company successfully replicates its domestic model overseas, it could unlock substantial revenue potential and attract a new wave of users. Also, as crypto adoption grows and global markets become more digitally native, Robinhood is well-positioned to benefit from these secular trends. For growth-oriented investors, this presents an opportunity – leading to the rise in conviction in the stock.

All in all, Robinhood is entering an interesting phase of its growth – which, as evident from the stock’s rising conviction, a growing number of investors are gloaming on to.

Footnotes:

1Robinhood Markets, Inc. and Consolidated Subisdiaries Monthly Metrics Report for July 2024

2Robinhood Markets, Inc. and Consolidated Subsidiaries Monthly Metrics Report for August 2025