KLA Corp, a leader in semiconductor manufacturing equipment, has seen its stock price climb significantly of late. Over the last year, the stock has more than doubled1 as investors have bet on increased demand for the company’s chip fabrication tools amid the artificial intelligence (AI) boom.

Wall Street sees further upside, however. Because KLA’s second quarter2 earnings were better than expected and the company’s guidance was strong.

Top and Bottom-Line Beat

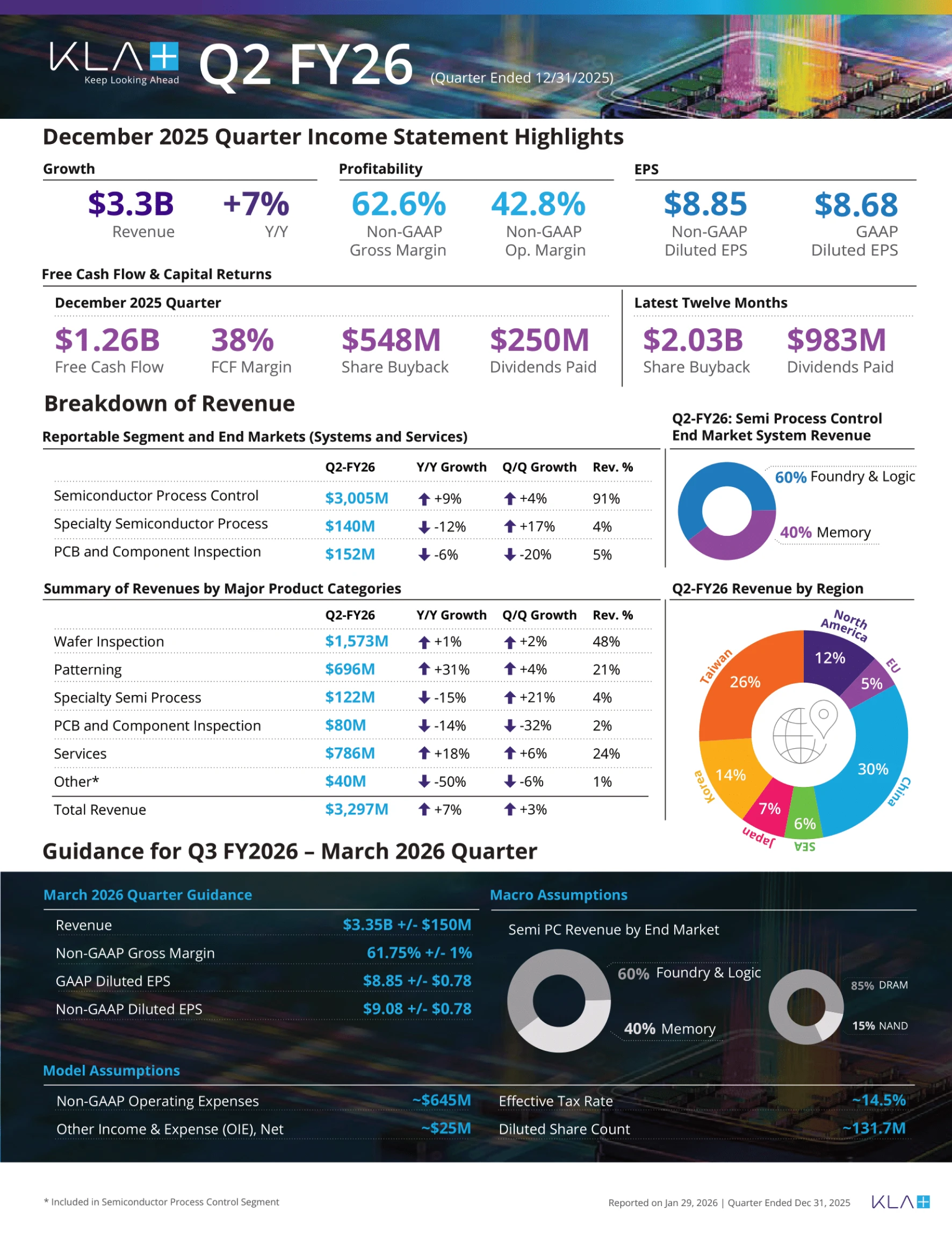

For Q2, KLA’s revenue amounted to $3.3 billion, up 7% year on year. This was ahead of the consensus forecast3 of $3.25 billion. Non-GAAP net income came in at $1,168 million, or $8.85 per share, versus $1,098 million, or $8.20 per share, a year earlier. Going into the print, analysts had been looking for $8.80.

For the 2025 calendar year, KLA’s revenue amounted to a record $12.75 billion. This was up 17% year on year. Earnings per share for the calendar year was up 29% year on year to $35.44. Meanwhile, free cash flow was up 30% to $4.4 billion.

In terms of guidance, the company said that it is targeting third-quarter revenue of $3.35 billion (+9.5% year on year), plus or minus $150 million. This forecast was above the consensus estimate of $3.28 billion. Earnings for the quarter are expected to be $9.08 plus or minus 78 cents versus analysts’ forecast of $8.94. "As we look forward to calendar year 2026, KLA is a key enabler of the AI ecosystem and continues to uniquely benefit from the AI infrastructure buildout across all major growth vectors, including foundry/logic, memory, advanced packaging, and services," commented President and CEO Rick Wallace.

Source: KLA, Q2 FY26, as of January 29, 2026

Earnings Call Highlights

It’s worth noting that on the Q2 earnings call, management highlighted “advanced packaging” as a key growth driver for the future. This is where chips are stacked on top of or very close to each other using microscopic connectors in an effort to enhance performance. In calendar year 2025, revenue from advanced packaging was approximately $950 million, up 70% year on year. The company expects the momentum here to continue in calendar 2026.

Also on the earnings call, management explained how KLA’s systems are applying AI-driven analytics to deliver actionable insights that streamline chip manufacturing and accelerate time to yield for next-generation AI applications. Looking ahead, management believes that its innovations with AI will produce actionable data for its customers that accelerate system performance, reduce the cost of ownership, and improve their return on investment in KLA systems.

Analysts See Upside Potential

Since the company’s Q2 earnings, analysts4 at Wells Fargo have raised their target price for KLA stock to $1,900 from $1,600 and reiterated their Buy rating. Analysts at Jefferies have also reiterated their Buy rating, lifting their price target to $1,850 from $1,500.

Other firms that have recently increased their price targets4 for the stock include Evercore ISI, Berenberg, Morgan Stanley, and TD Cowen. These firms have price targets of $1,700, $1,760, $1,694, and $1,800 respectively.

Footnotes:

1KLA Corporation Reports Fiscal 2026 Second Quarter Results, as of January 29, 2026

2Newsfile Refinitiv, as of January 29, 2026

3KLA, Q2 FY26, as of January 29, 2026

4Investing.com, KLA Corporation (KLAC), as of January 29, 2026