While Nvidia tends to steal the spotlight, there’s another chip company that’s integral to the artificial intelligence (AI) boom and that’s ASML. It specializes in the design and manufacture of Extreme Ultraviolet (EUV) lithography systems – sophisticated machines that are crucial for the production of the advanced chips used in AI applications.

Recently, ASML posted its earnings for the fourth quarter of 20251 and they showed that the AI boom is fueling growth right now. Here’s a look at some highlights from the report, and analysts’ reactions to the print.

Record Bookings in Q4

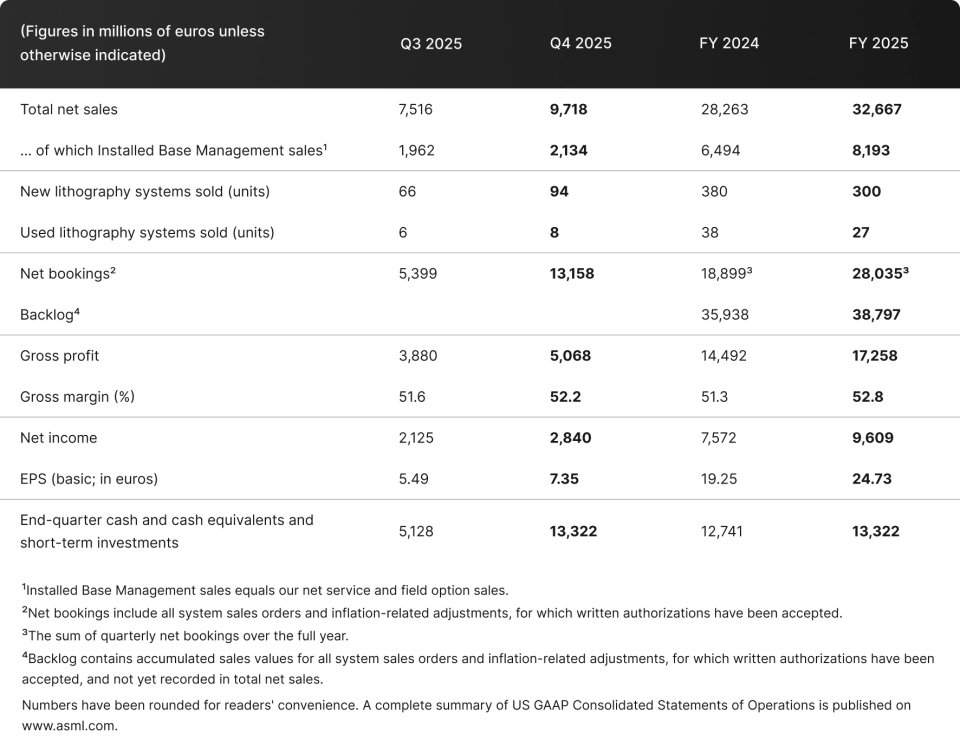

For the fourth quarter of 2025, ASML’s total net sales came in at €9.7 billion versus €7.5 billion for the third quarter. During the quarter, the company sold 94 new lithography systems compared to 66 systems in Q3.

Net bookings – a closely-watched metric – was a record €13.2 billion. This was well ahead of analysts’ forecast2 of €6.3 billion.

Net income for the period amounted to €2.8 billion, up from €2.1 billion in the previous quarter. Meanwhile, earnings per share was €7.35 versus €5.49 in Q3.

Source: ASML earnings report, as of January 28, 2026

Strong Guidance

Looking ahead, the company said that it expects total sales for 2026 to be between €34 billion and €39 billion versus €32.7 billion for 2025. Going into the print, the average forecast was €35.1 billion.

The company noted here that its customers have recently been more positive in their assessment of the medium-term outlook for AI demand. As a result, these customers are investing in capacity.

New Share Buyback Program and Higher Dividend

On the back of these strong results, the company announced a €12 billion share buyback plan. This is to be executed by December 31, 2028.

It also increased its annual dividend to €7.50 per ordinary share. That represents a 17% increase on the dividend for 2024.

Analysts are Bullish on ASML

After the Q4 results, several firms including BofA Securities, Wolfe Research, and Evercore ISI reiterated their “Buy” ratings for the chip stock. These firms have price targets3 of €1,454, €1,400, and €1,300 respectively. Analysts at Jefferies noted that the company’s valuation is high at present but said that the positive industry news is likely to provide further medium-term upside. In light of this bullish sentiment, this could be a chip stock to watch in 2026.

Footnotes:

1ASML, Press Release Financial Results Q4 FY 2025, as of January 28, 2025

2Investing.com, ASML stock jumps as Q4 bookings hit record €13.2 bln, doubling analyst forecasts, as of January 28, 2025

3Investing.com, ASML Holding NV (ASML), as of January 28, 2025