Computer chips lie at the heart of the artificial intelligence (AI) revolution we’re experiencing today. Responsible for handling the enormous computational demands of AI, these tiny electronic devices are powering everything from large language models (LLMs) to autonomous vehicles.

Recently, two key players in the AI chip ecosystem, Taiwan Semiconductor (TSMC) and ASML, posted their earnings for the second quarter of 2025, offering a snapshot of their recent performance. Here’s a look at the numbers and what they mean for investors.

Taiwan Semiconductor: Benefitting from Advanced Chip Demand

Taiwan Semi, the world’s largest chip manufacturer, posted strong Q2 earnings1, driven by high demand for AI chips. For the quarter, revenue increased 38.6% year on year to NT$933.8 billion (US$30.1 billion). As for net income, it came in at NT$398.3 billion, up 61% from the figure of NT$247.9 billion posted a year earlier.

Zooming in profitability, gross margin for the quarter was 58.6% while operating margin was 49.6%. Rewind to Q2 20242 and these figures were 53.2% and 42.5% respectively, so there was a material increase in profitability here.

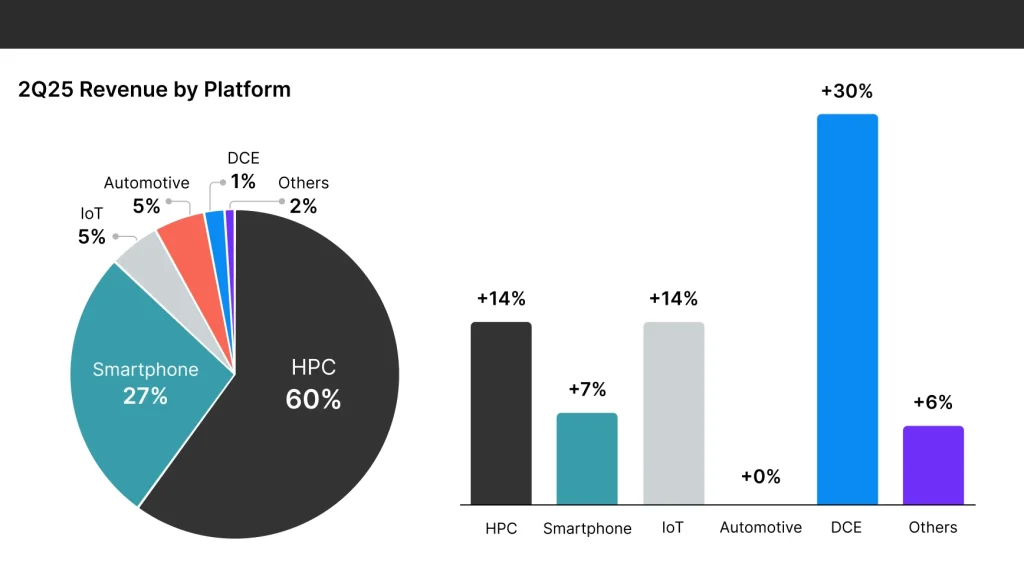

Digging into the earnings, it was TSMC’s high-performance computing (HPC) division – which encompasses AI and 5G applications – that drove second quarter sales. This contributed approximately 60% of revenue versus 52% a year earlier. Advanced technologies – defined as chips smaller than 7-nanometer – accounted for 74% of total wafer revenue. That was up from 67% in Q2 2024 so clearly demand for advanced AI chip technology has increased.

Source: TSMC, as of July 17, 2025

Looking ahead, management was optimistic in relation to the near-term outlook. “Moving into third quarter 2025, we expect our business to be supported by strong demand for our leading-edge process technologies,” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. Currently, the group expects revenue for the third quarter to be between US$31.8 billion and US$33.0 billion. Last year, Q3 revenue was $23.5 billion, so that forecast represents a significant level of growth.

Note that on the Q2 earnings call, TSMC CEO C.C. Wei said that the company expects full-year 2025 revenue to rise by around 30% in US dollar terms, supported by AI growth and demand for its most advanced technologies. That is a significant level of top-line growth, and it indicates that the company expects AI chip demand to remain elevated.

Overall, it was a good earnings report from TSMC. Not only was revenue growth high but profitability was up substantially. Looking ahead, the chip manufacturer appears well positioned to continue growing, thanks to strong demand for AI chips. However, it should be noted that the company faces potential headwinds from US trade policy as President Donald Trump has threatened steep “reciprocal tariffs” on Taiwan.

ASML: Sales at Top End of Guidance

Shares in ASML – which makes chip manufacturing equipment for the likes of Taiwan Semiconductor, Intel, and Samsung – took a double-digit percentage3 hit after the company posted its Q2 earnings4. But the earnings report wasn’t terrible; in fact, it was quite good with sales beating expectations.

For the period, ASML’s total net sales came in at €7.7 billion, 24% higher than the figure posted a year earlier and at the top end of the firm’s guidance. Net income was €2.3 billion, up 44% on the figure of €1.6 billion for Q2 20245. Gross margin for the quarter was 53.7% versus 51.5% a year earlier. So, like TSMC, profitability improved year on year.

Digging deeper, installed base management sales came in at €2.1 billion versus €1.5 billion a year earlier. That represented a 40% increase and showed that the company is having success on the service side of its business. Of Q2 quarterly net bookings, which were €5.6 billion, €2.5 billion was from extreme ultraviolet (EUV) lithography machines, showing that a substantial proportion of bookings are for the company’s most advanced chip manufacturing technology (where it has a monopoly in terms of production).

As for what caused the chip stock to experience weakness, it was the company’s guidance. While ASML expects top-line growth of 15% this year, it was unable to confirm that it will see growth next year due to economic and geopolitical uncertainty and this spooked investors.

Was the double-digit percentage share price drop an overreaction? Possibly. There is no doubt that there is some uncertainty here due to tariffs and export restrictions. However, it would be surprising if ASML experienced no growth next year given that it is one of the most important companies in the AI ecosystem globally.

Footnotes:

1TSMC, TSMC Reports Second Quarter EPS of NT$15.36, as of July 17, 2025

2TSMC, TSMC Reports Second Quarter EPS of NT$9.56, as of July 18, 2025

3CNBC, ASML shares drop 11% after the chip giant says it can’t confirm that it will grow in 2026, as of July 16, 2025

4ASML, ASML reports €7.7 billion total net sales and €2.3 billion net income in Q2 2025, as of July 16, 2025

5ASML, ASML reports €6.2 billion total net sales and €1.6 billion net income in Q2 2024, as of July 17, 2025

img